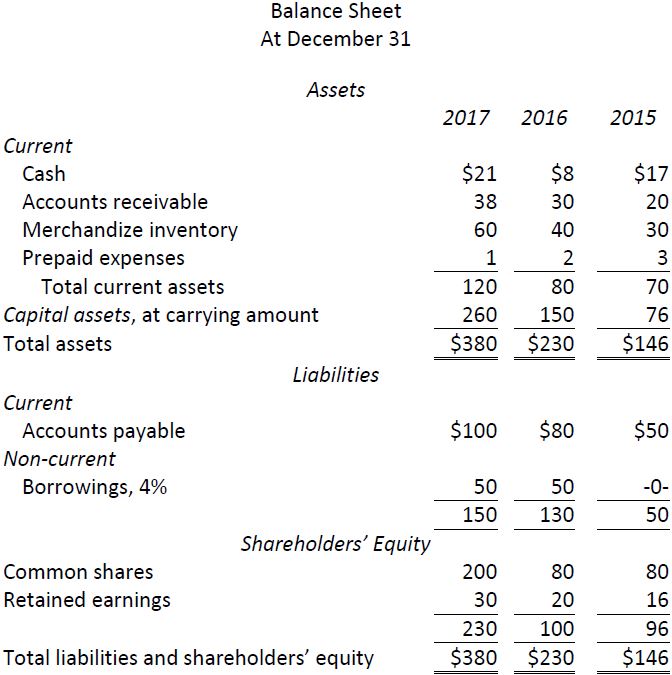

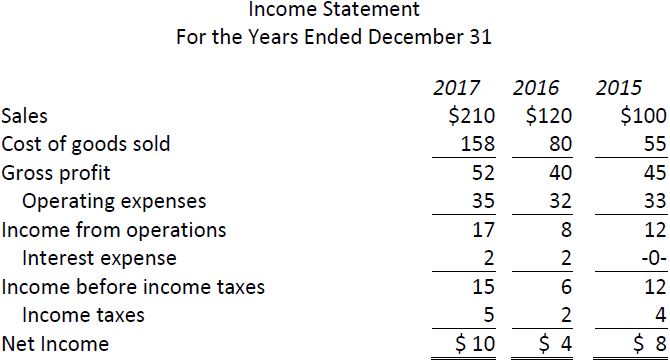

The following are condensed comparative financial statements of Stockwell Inc. for the three years ended December 31, 2017.

Additional information:

|

a. |

The company’s accounts receivable at December 31, 2014 totalled $20. |

|

b. |

The company’s merchandize inventory at December 31, 2014 totalled $20. |

|

c. |

The company’s capital assets at December 31, 2014 totalled $70. |

|

d. |

Credit terms are net 60 days from date of invoice. |

|

e. |

Number of common shares outstanding: 2015—80, 2016—80, 2017—400. |

For discussion:

- Calculate liquidity ratios and discuss.

- What is your evaluation of

- The financial structure of the corporation?

- The proportion of shareholder and creditor claims to its assets?

- The structure of its short-term and long-term credit financing?

- What are some other observations you can make about the financial performance of Stockwell?

- (Appendix) Restate the financial statements to facilitate Scott formula analysis. Then calculate this formula for 2016 and 2017, and analyze your results. Does this analysis change any or your observations in part 3?

- 1946 reads