Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

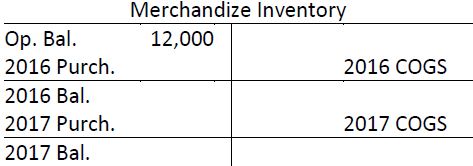

Partial information from the Merchandize Inventory general ledger account for Belton Ltd. is as follows:

The 2016 ending inventory was counted and valued incorrectly at $13,000. This was overstated by $3,000. The 2017 ending inventory was also valued incorrectly at $9,000. This was overstated by $4,000. Purchases for each year amounted to $30,000. Sales totalled $50,000 for each year.

Required:

- Fill in the missing general ledger account information assuming the ending inventory was correctly counted and valued each year; and the ending inventory was incorrectly counted and valued each year. Show necessary inventory adjustments.

- Prepare partial income statements based on the assumptions in (a). Calculate the cumulative effect of the 2016 and 2017 ending inventory errors on 2017 gross profit.

- 1748 reads