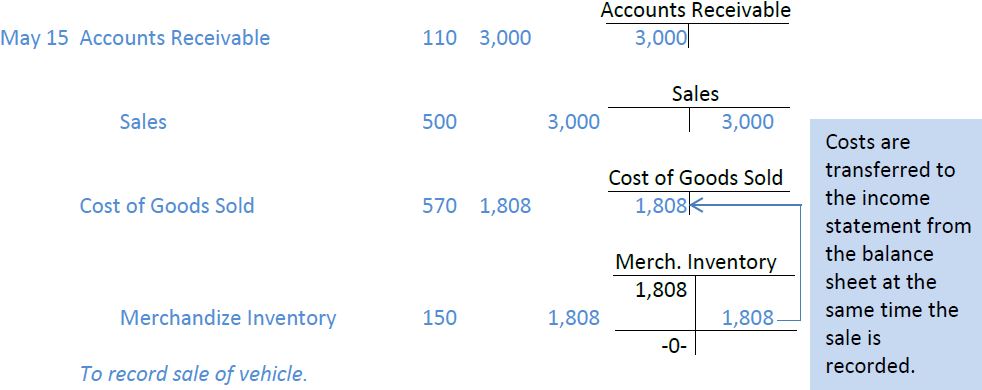

The sale of merchandize inventory is recorded with two entries:

- recording the sale by debiting Cash or Accounts Receivable and crediting Sales, and

- recording the cost of the sale by debiting Cost of Goods Sold and crediting Merchandize Inventory.

Assume the vehicle purchased by Excel is sold on May 15 for $3,000 on account. Recall that the cost of this vehicle in the Excel Merchandize Inventory account is $1,808, as shown below.

The entries to record the sale of the merchandize inventory are:

The first part of the entry records the sales revenue. The second part is required to reduce the Merchandize Inventory account and transfer the cost of the merchandize sold to the Cost of Goods Sold account, and then to the income statement. The part of the entry ensures that both the Merchandize Inventory and Cost of Goods Sold accounts in the general ledger are up to date.

- 2247 reads