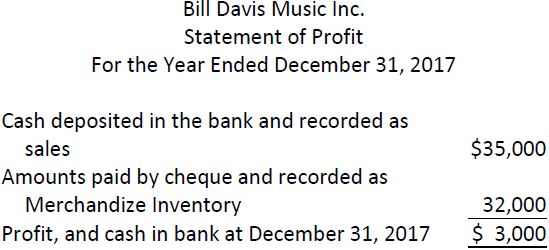

Bill Davis Music Inc. is a store that sells musical instruments. After operating the store for one year, the owner prepared the following income statement for the fiscal year ended December 31, 2017:

Mr. Davis, the owner, has hired you as an accountant and financial consultant. In one of your first conversations with him, he says, “This business is fantastic. I never expected to make a profit until the second or third year of operations, but not once during the past year did we ever overdraw our chequing account.’’ The items listed below come to your attention during the first few weeks on the job:

|

a. |

On December 31, 2017, customers owed the company $12,500 from the sale of instruments on credit. |

|

b. |

Mr. Davis has not paid rent for October, November, and December, 2017. Monthly rental for the retail space is $1,000. |

|

c. |

Mr. Davis financed the business with a $10,000, loan from his father, repayable in five years. Accrued interest payable on the loan at December 31, 2017 is $2,500. |

|

d. |

The company issued share capital of $100 to Mr. Davis for cash on January 1, 2017. |

|

e. |

Merchandize inventory on hand at December 31, 2017 totalled $500. |

Required:

- Based on Mr. Davis’ statements and actions, how do you think he defines the term profit? Did Mr. Davis violate generally accepted accounting principles in preparing his statement of profit? Explain.

- Prepare adjusting and closing entries needed at December 31, 2017 and post to general ledger T-accounts. Include general ledger account numbers and a brief description for each entry.

- Prepare an income statement for the year ended December 31, 2017 and a balance sheet at December 31.

- Comment on the revised results.

- 2114 reads