The periodic inventory system does not maintain a constantly-updated merchandize inventory balance. Instead, ending inventory is determined by a physical count and valued at the end of an accounting period. The change in inventory is recorded only periodically. Additionally, a Cost of goods sold account is not maintained in a periodic system. Instead, cost of goods sold is calculated at the end of the accounting period.

When goods are purchased using the periodic inventory system, the cost of merchandize is recorded in a Purchases account in the general ledger, rather than in the Merchandize Inventory account as is done under the perpetual inventory system. The Purchases account is an income statement account that accumulates the cost of merchandize acquired for resale.

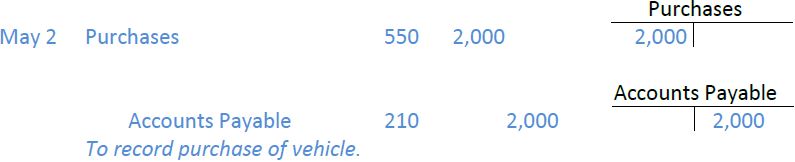

Recall that Excel purchased a vehicle on account from its supplier on May 2 for $2,000. The journal entry and general ledger T-account effects using the periodic inventory system would be as follows:

Other types of activities related to the purchase of merchandize, like allowances for damaged items, purchase discounts, and transportation and handling charges, are not recorded in the Merchandize Inventory account either. Rather, they are recorded in special income statement accounts. Accounting for each type of transaction is explained below.

- 2360 reads