Journal entries to record interest payments and amortization of the premium are made every June 30 and December 31 in the same manner as for straight-line amortization shown in section C. The actual interest paid to bondholders amounts to $6,000 each semi-annual period; the amount of premium amortization for each period is taken from column D of the amortization table. These are the entries for June 30, 2015.

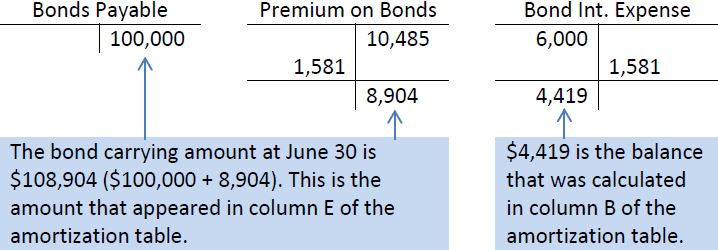

The entries for each remaining period are similar; only the amounts used for premium amortization differ, as shown in column D of the amortization table. After posting the June 30 entries, the following balances result:

Note that the effective interest rate based on the income statement interest expense and the opening bond carrying value shown on the balance sheet is 4% ($4,419/110,485, rounded).

- 2070 reads