| LO1 – Calculate cost of goods sold and merchandize inventory under specific identification, firstin first-out (FIFO), and weighted average cost flow assumptions using the perpetual inventory system. |

Determining the cost of each unit of inventory, and thus the total cost of ending inventory on the balance sheet, can be challenging. Why? We know from Chapter 5 that the cost of inventory can be affected by discounts, returns, transportation costs, and shrinkage. Additionally, the purchase cost of an inventory item can be different from one purchase to the next. For example, the cost of coffee beans could be $5.00 a kilo in October and $7.00 a kilo in November. Finally, some types of inventory flow into and out of the warehouse in a specific sequence, while others do not. For example, milk would need to be managed so that the oldest milk is sold first. In contrast, a car dealership has no control over which vehicles are sold because customers make specific choices based on what is available. So how is the cost of a unit in merchandize inventory determined? There are several methods that can be used. Each method may result in a different cost, as described in the following sections.

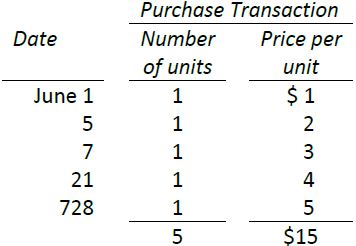

Assume a company sells only one product and uses the perpetual inventory system. It has no beginning inventory at June 1, 2015. The company purchased five units during June as shown in Figure 6.1.

At June 28, there are 5 units in inventory with a total cost of $15 ($1 +$2 + $3 + $4 + $5). Assume four units are sold June 30 for $10 each on account. The cost of the four units sold could be determined based on identifying the cost associated with the specific units sold. For example, a car dealership tracks the cost of each vehicle purchased and sold. Alternatively, a business that sells perishable items would want the oldest units to move out of inventory first to minimize spoilage. Finally, if large quantities of low dollar value items are in inventory, such as pencils or hammers, an average cost might be used to calculate cost of goods sold. A business may choose one of three methods to calculate cost of goods and the resulting ending inventory based on an assumed flow. These methods are: specific identification, FIFO, and weighted average, and are discussed in the next sections.

- 3306 reads