| LO3 – Describe how bond premiums and discounts are amortized. |

The mechanisms whereby the market establishes a price for a bond issue are complex. Some of the considerations include present valuecalculations. These are explained further in appendix 1.

In order to focus on the accounting process associated with bonds covered in this section, any applicable premiums or discounts will be provided, and a simplified method of amortizing the bond premium or discount presented. Under GAAP, the effective interest method of amortizing bond premiums and discounts must be used. This technique is discussed in appendix 2.

In this section, assume the following three scenarios:

|

1. |

Big Dog Carworks Corp. issues $100,000 of 3-year, 12% bonds on January 1, 2015. Market value is the same as face value ($100,000). The journal entry to record the sale would

be: |

|

2. |

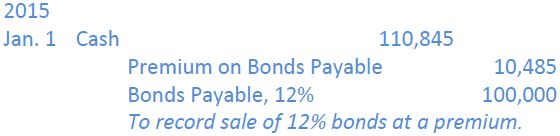

BDCC’s bonds are issued at a premium because the market rate of interest is 8% at the date of issue for similar bonds offered in the market. (The difference between the 12% rate on

the BDCC bonds and the market rate of 8% is exaggerated for purposes of illustration. In reality, these differences are generally fractions of a%.) As a result, market value is

$110,485. The premium is $10,485 ($110,845 – 100,000). The journal entry to record the sale would be: |

|

3. |

BDCC’s bonds are issued at a discount. Market value is $90,754 because the market rate of interest is 16%. The discount is $9,246 ($100,000 – 90,754). The journal entry to record

the sale on would be: |

Interest begins to accumulate from the previous interest payment date of the bond and is usually paid semi-annually regardless of when the bond is actually sold. Interest paid to bondholders is always calculated based on the face value of the bond, regardless of whether the bonds are issued at par, at a premium, or at a discount. BDCC’s $100,000 bond issue with an interest rate of 12% pays $12,000 interest each year. This interest is usually paid semi-annually, that is, individual bondholders would receive $6,000 every six months.

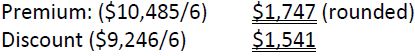

As noted previously, any premium or discount is assumed to be amortized over the life of the bond in equal amounts. An entry is made at each point interest is paid. BDCC’s bonds are issued for three years and interest will be paid twice each year, on June 30 and December 31 for a total of six payment dates. For our purposes, the premium or discount will be amortized on a straight-line basis over these six periods, in the following amounts:

The journal entries to record interest payments for the first year of BDCC’s $100,000 bond issue, together with the appropriate amortization entry, are recorded below.

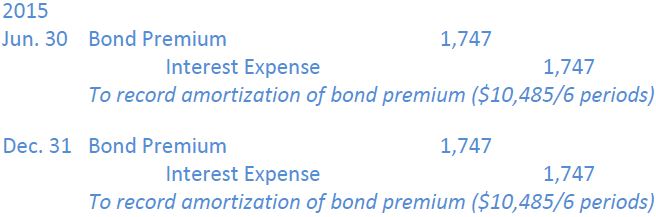

The additional adjusting entries to record the 2015 amortization of the bond premium under scenario 2 are:

The additional adjusting entries to record the 2015 amortization of the bond discount under scenario 3 are:

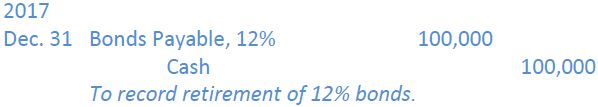

Similar entries are made each June 30 and December 31 until the bonds are retired in three years. At maturity on December 31, 2017, the bonds are retired by the payment of cash to bondholders.

The usual entries would be made to record the payment of semiannual interest and amortization of the premium or discount, as well as this final entry:

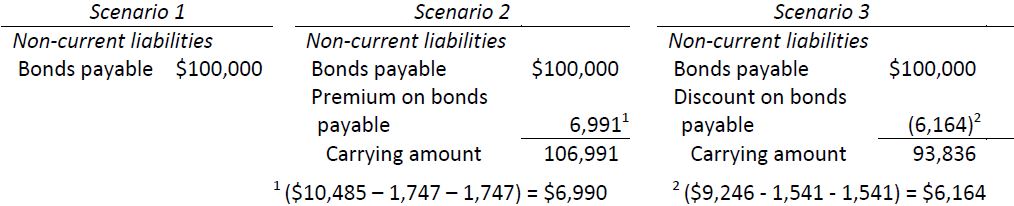

The bonds payable would be recorded as non-current liabilities at December 31, 2015. The balance sheet presentation under each of the three scenarios would be:

Alternately, just carrying amounts could be shown on the balance sheet. If so, details about face value and unamortized premiums or discounts would be disclosed in a note to the financial statements along with other pertinent details like interest rate, maturity date, and bond indenture provisions.

The bonds mature on December 31, 2017. When the bonds become payable within one year from the balance sheet date, they are classified as current liabilities. This would be done on the December 31, 2016 BDCC balance sheet, along with any unamortized premium or discount.

- 2946 reads