A simplified method of straight-line depreciation was introduced in Chapter 3. This method assumes that the asset will contribute to the earning of revenues equally each time period. Therefore, equal amounts of depreciation are recorded during each year of the asset’s useful life.

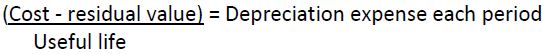

Straight-line depreciation is calculated as:

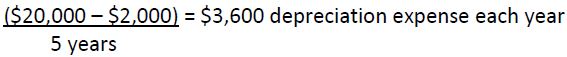

To demonstrate, assume the same $20,000 piece of equipment used earlier, with a useful life of five years and a residual value of $2,000. Straight-line depreciation would be $3,600 per year calculated as:

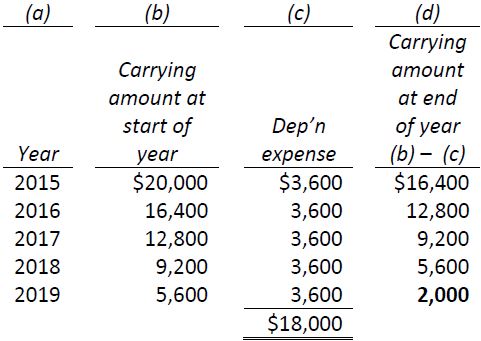

Over the five-year useful life of the equipment, depreciation expense and carrying amounts will be as follows:

The carrying amount at December 31, 2015 will be the residual value of $2,000.

| Under the straight-line method, depreciation expense for each accounting period remains the same dollar amount over the useful life of the asset. |

- 5717 reads