| LO6 – Explain the closing process for a merchandizer. |

The process of recording closing entries for service companies was illustrated in Chapter 3. The closing procedure for merchandizing companies is the same as for service companies—all income statement accounts are transferred to the Income Summary account, the Income Summary is closed to Retained Earnings, and Dividends are closed to Retained Earnings.

When preparing closing entries for a merchandizer, the income statement accounts unique for merchandizers need to be considered—Sales, Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold. Sales is a revenue account so has a normal credit balance. To close Sales, it must be debited with a corresponding credit to the income summary. Sales Discounts and Sales Returns and Allowances are both contra revenue accounts so each has a normal debit balance. Cost of Goods Sold has a normal debit balance because it is an expense. To close these debit balance accounts, a credit is required with a corresponding debit to the income summary.

All accounts listed in the income statement columns are transferred to the income summary account, and then the income summary is closed to retained earnings. The same three-step process is used, as shown in chapter 3, as applied to the financial information of Excel Cars Corporation for the year ended December 31, 2016:

Entry 1

All income statement accounts with credit balances are debited to bring them to zero. Their balances are transferred to the income summary account.

Entry 2

All income statement accounts with debit balances are credited to bring them to zero. Their balances are transferred to the income summary account.

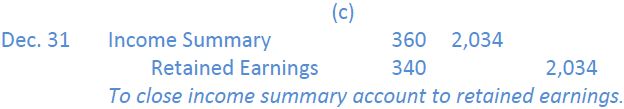

Entry 3

The Income Summary account is closed to the Retained Earnings account. The effect is to transfer temporary (income statement) account balances in the income summary totalling $4,034 to the permanent (balance sheet) account, Retained Earnings.

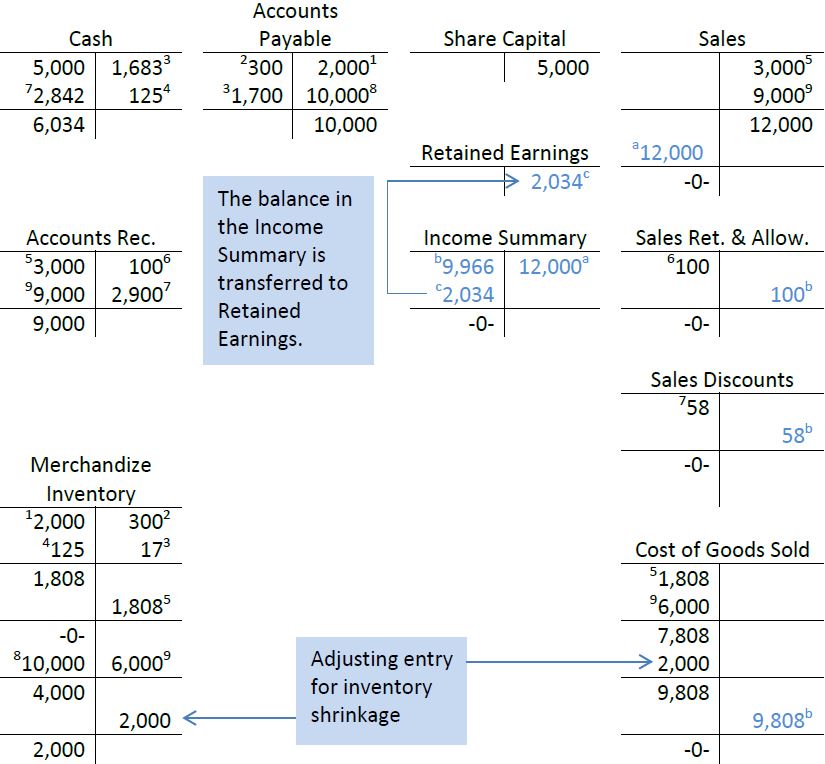

After these closing entries are posted, the general ledger T-accounts would appear as follows:

All income statement accounts and the income summary account are reduced to zero and net income for the year of $2,034 is transferred to retained earnings.

- 44864 reads