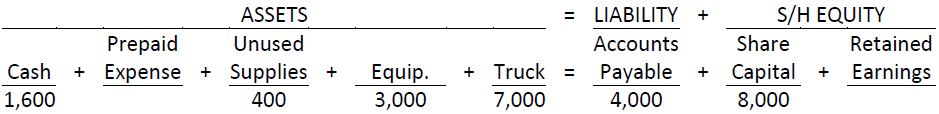

The following amounts appeared on the transactions worksheet of Snider Truck Rentals Corporation on May 1, 2015.

The following transactions occurred during May:

|

a. |

Collected $5,000 cash for tool rental during the month |

|

b. |

Paid $500 rent expense |

|

c. |

Paid $1,500 cash to satisfy an account payable |

|

d. |

Paid $600 for a one-year insurance policy effective May 1 (record the asset as prepaid expense) |

|

e. |

Purchased used truck for $5,000 on credit |

|

f. |

Paid the following expenses: advertizing, $300; salaries, $2,500; telephone, $150; truck operating, $550 |

|

g. |

Transferred the amount of May’s insurance ($50) to insurance expense |

|

h. |

Estimated $200 of supplies to have been used during May |

|

i. |

Issued additional share capital and received $1,000 cash |

|

j. |

Paid $300 dividend in cash. |

Required: Record the above transactions on a transactions worksheet and calculate the total of each column at the end of May.

- 2670 reads