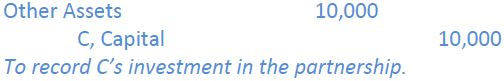

Rather than purchase an existing partner’s interest, the new partner could contribute cash or other assets in return for a partnership interest. This method differs from the purchase of an existing partner’s interest; in this case, both the assets and equity of the partnership are increased. Assume that C contributes assets at their fair value of $10,000 (referred to as other assets for illustrative purposes) to the partnership for a one-third interest in the partnership capital after his contribution. This investment is recorded as follows:

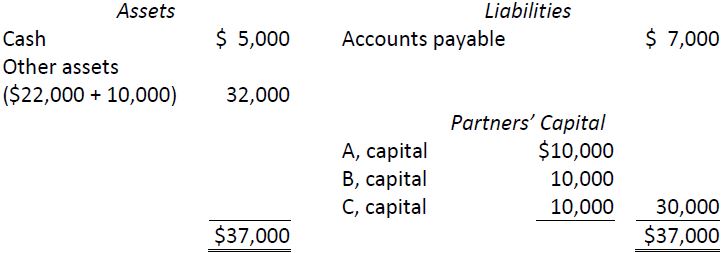

Following the investment, the balance sheet would appear as follows:

In some cases, C may receive more or less than a $10,000 capital balance because a bonus may be given either to the new partner or to the existing partners.

The partnership may want to add a new partner who can bring certain technical skills, management abilities, or some other desirable business strengths. To entice a desirable individual, a bonus may be offered in excess of the amount invested by the new partner. In this case, the existing partners allocate a portion of their capital to C.

- 2554 reads