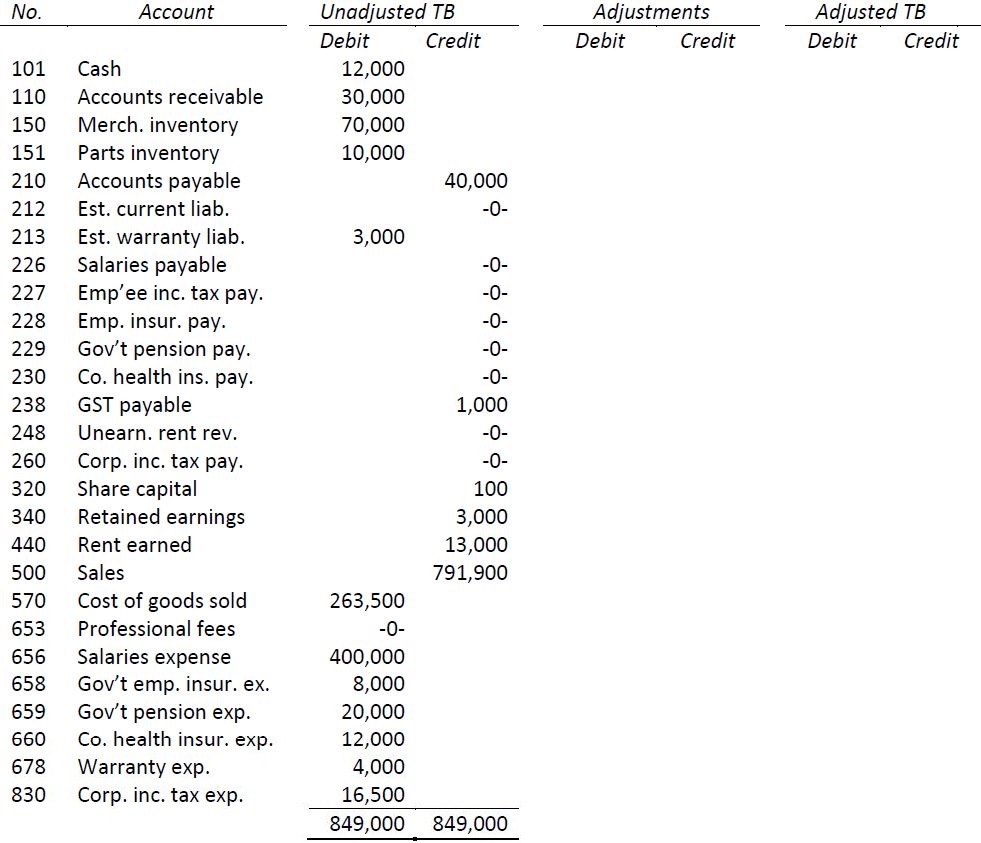

The following unadjusted trial balance has been taken from the records of Mudryk Wholesalers Corp. at December 31, 2016:

The following additional information is available at the year-end. GST of 5% only applies when indicated.

|

a. |

The company has sublet space in its leased facilities to another company for $1,000 per month since January 1. |

||

|

b. |

A review of warranty claims indicates that the following amounts have been incorrectly recorded in income statement general ledger accounts: |

||

|

Cost of goods sold |

$500 |

||

|

Salaries expense |

$100 |

||

|

c. |

A $4,000 purchase of parts inventory on account plus GST has not been recorded. |

||

|

d. |

Warranty expense for the year is estimated at 1% of sales. |

||

|

e. |

Unpaid gross salaries amount to $5,000. Deductions from gross pay are as follows: |

||

|

Employee income taxes |

15% |

||

|

Government employment insurance |

2% |

||

|

Government pension |

5% |

||

|

Company health insurance |

3% |

||

|

The company matches employee contributions to the employment insurance, government pension, and company health insurance plans on a 1 to 1 basis. |

|||

|

f. |

Audit fees are estimated to be $8,000. |

||

|

g. |

The corporate income tax rate is 25% of income before income taxes. Corporate income tax instalments during the year have been recorded as income taxes expense in the records. |

||

Required:

- Prepare necessary adjusting entries at December 31, 2016. Include descriptions and general ledger account numbers, and calculations if necessary.

- Post the entries to the worksheet and prepare an adjusted trial balance.

- Prepare a classified income statement and statement of changes in equity for the year ended December 31, and a classified balance sheet at December 31. Consider salary, benefits, and warranty expenses to be selling expenses. No shares were issued during the year.

- 1888 reads