Latex Paint Corporation started operations on January 1, 2016. It had the following transactions during the year.

|

a. |

Jan. 1 |

Issued $20,000 share capital to the shareholders in return for cash. |

|

|

b. |

Jan. 1 |

Obtained a bank loan totalling $30,000. The interest rate is 4%. The loan will be repaid in one year. |

|

|

c. |

Jan. 2 |

Purchased merchandize on account from a supplier for $20,000 plus GST (5%). |

|

|

d. |

Jan. 8 |

Sold $8,000 of paint to a customer on credit and added GST. Cost of the pain sold was $3,000. Latex uses the perpetual inventory method. |

|

|

e. |

Jan. 15 |

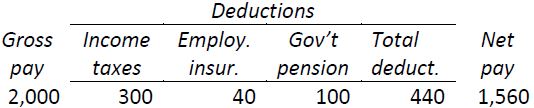

Paid an employee J. Jones $1,560 cash for January 1-15 salary, calculated as follows: |

|

|

|||

|

The company’s portion of contributions is: |

|||

|

Employment insurance |

1.4 times |

||

|

Government pension |

1 time |

||

|

f. |

Unrecorded liabilities at January 31 include: |

||

|

i. |

Salaries payable to J. Jones for January 16-31, amounting to $1,560 (net). Employer contributions are as shown in e. above. |

||

|

ii. |

Corporate income taxes amounting to 20% of income before income taxes. |

||

Required:

- Prepare journal entries to record the above transactions. Show necessary calculations.

- Prepare all adjusting entries needed at January 31, 2016. Show necessary calculations.

- Calculate total current liabilities at January 31, 2016.

Descriptions and general ledger account numbers are not necessary.

- 1836 reads