Under specific identification, each inventory item that is sold is matched with its purchase cost. This method is most practical when inventory consists of relatively few, expensive items, particularly when individual units can be identified with serial numbers—for example, motor vehicles.

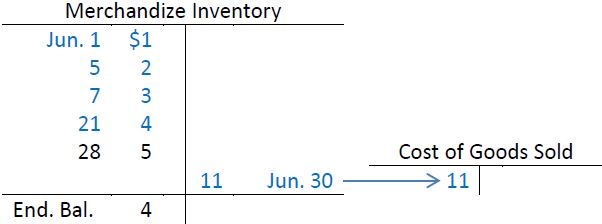

Assume the four units sold on June 30 are those purchased on June 1, 5, 7, and 28. The fourth unit purchased on June 21 remains in ending inventory. Cost of goods sold would total $11 ($1 + $2 + $3 + $5). Sales would total $40 (4 @ $10). As a result, gross profit would be

$29 ($40 – 11). Ending inventory would be $4, the cost of the unit purchased on June 21.

The general ledger T-accounts for Merchandize Inventory and Cost of Goods Sold would show:

The entry to record the June 30 sale on account would be:

It is not possible to use specific identification when inventory consists of a large number of similar, inexpensive items that cannot be easily differentiated. Consequently, a method of assigning costs to inventory items based on an assumed flow of goods can be adopted. Two such generally accepted methods, known as cost flow assumptions, are discussed next.

- 2711 reads