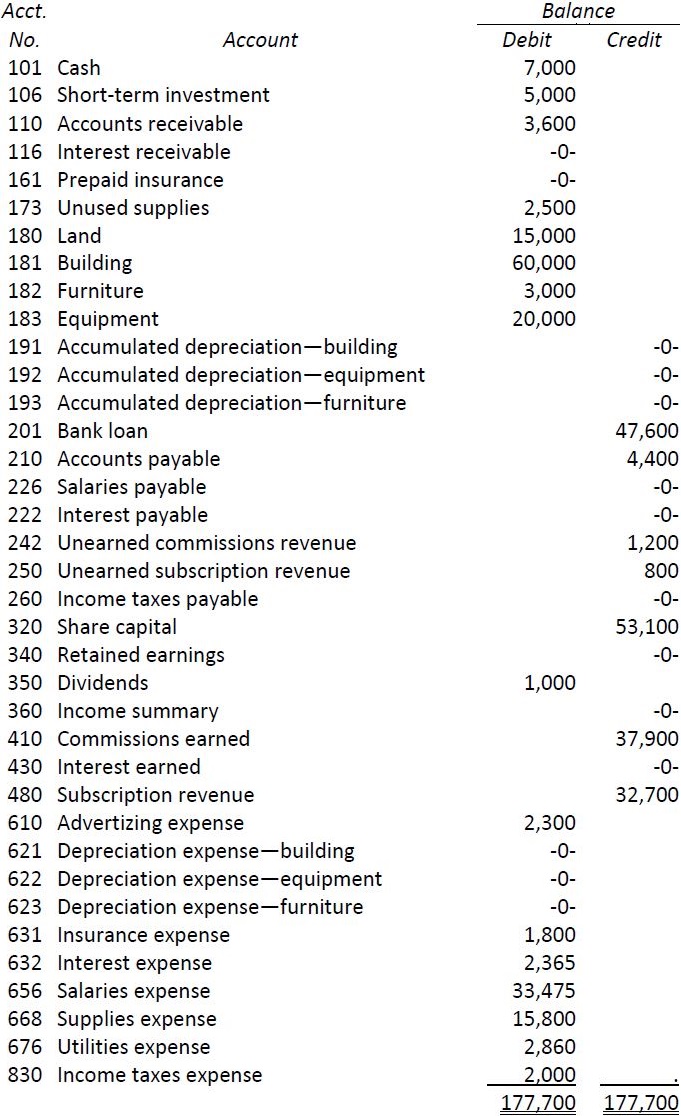

The unadjusted trial balance of Packer Corporation showed the following balances at the end of its first 12-month fiscal year ended August 31, 2016:

At the end of August, the following additional information is available:

|

a. |

The company’s insurance coverage is provided by a single comprehensive 12-month policy that began on March 1, 2016. |

|

b. |

Supplies on hand total $2,850. |

|

c. |

The building has an estimated useful life of 50 years . |

|

d. |

The furniture has an estimated useful life of ten years . |

|

e. |

The equipment has an estimated useful life of 20 years . |

|

f. |

Interest of $208 on the bank loan for the month of August will be paid on September 1, when the regular $350 payment is made. |

|

g. |

Unearned commission revenue is $450. |

|

h. |

Unearned subscription revenue is $2,800. |

|

i. |

Salaries that have been earned by employees in August but are not due to be paid to them until the next payday (in September) amount to $325. |

|

j. |

Accrued interest from the short-term investments amounts to $50. |

|

k. |

An additional $1,000 of income taxes is payable. |

Required:

- Set up necessary general ledger T-accounts and record their unadjusted balances. Include general ledger account numbers.

- Prepare the adjusting entries. Include general ledger account numbers and applicable calculations. Descriptions are not needed.

- Post the adjusting entries to the general ledger T-accounts and calculate balances.

- Prepare an adjusted trial balance at August 31, 2016.

- Prepare an income statement, statement of changes in equity, and balance sheet.

- Prepare and post the closing entries, including descriptions.

- Prepare a post-closing trial balance.

- 2173 reads