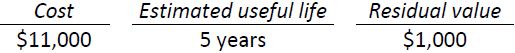

Spellman Inc. purchased its first piece of equipment on January 1, 2016. The following information pertains to this machine:

As the chief accountant for the company, you need to choose the depreciation method to be used.

|

Required: |

|

|

1. |

Calculate the straight-line and double-declining balance method depreciation for 2016, 2017, and 2018. Assume the ½ year rule does not apply to any of these years. |

|

2. |

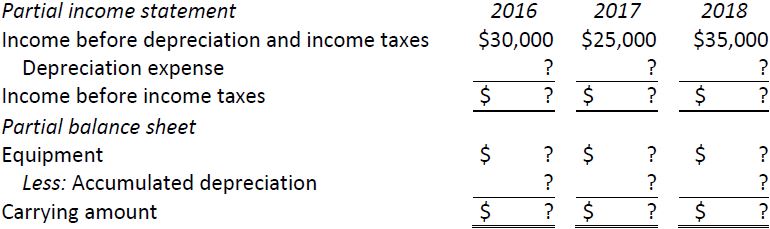

Using the format provided, complete comparative partial income statements and balance sheets at December 31 for both the straight-line and declining balance methods of depreciation. |

|

|

|

3. |

Which depreciation method should be used to maximize income before income taxes? to maximize the equipment’s carrying amount at December 31, 2018? Explain. |

- 1957 reads