Some revenues and expenses increase as time passes and are therefore said to accrue. Accrued revenues and accrued expenses are items that need to be reported in the income statement for a certain time period. However, they are not recognized by the accounting system until they are received or paid in cash, because there are no source documents like sales invoices or purchase invoices to trigger their recording. Often these types or revenue and expenses need to be recognized earlier in the accounting records. This is done by adjusting entries. Common types of accrued revenues are rent and interest from investments. Common expenses are interest on debt, salaries, and income taxes.

Accrued revenues are revenues that have been earned but not yet collected or recorded. Assume that BDCC has rented out part of the building in which it operates to another business (this is often called a sublet) as of January 1, 2015. The rent is $400 per month. If the rent has not been paid to BDCC by January 31, and an accrued revenue amount needs to be recorded, as follows:

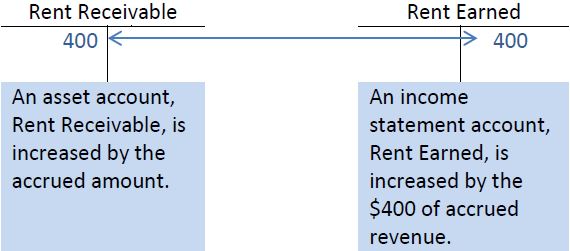

When the adjusting entry is posted, the accounts appear as follows:

In this way, rent revenue would be appropriately reported in the January income statement. If the adjustment was not recorded, assets on the balance sheet would be understated by $200 and revenues would be understated by the same amount on the income statement.

If the rent payment is received on February 3, the entry to record this would be:

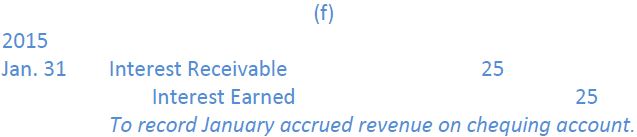

Another example of accrued revenue is interest receivable. Assume that cash on deposit with the bank pays interest every three months and that the interest revenue earned on the account is $25 at January 31. An accrued revenue amount needs to be recorded at January 31, as follows:

When the adjusting entry is posted, the accounts appear as follows:

Accrued expenses are expenses that have been incurred but not yet paid or recorded. Like accrued revenue, these items are not usually recorded in the accounting records because they are not recorded on source documents like a sales invoice or a bill from a supplier. An example of an accrued expense in the case of BDCC is interest expense. Interest expense arises when a business borrows money from a financial institution like a bank. Interest accrues (increases) daily but is paid only at certain time, perhaps monthly or every six months.

For Big Dog Carworks Corp., the January 31, 2015 unadjusted trial balance shows a $9,000 bank loan balance. Recall from Chapter 2 that this consists of a $4,000 loan on January 2 (Transaction 2), an additional $7,000 loan on January 3 (Transaction 3), and a repayment of $2,000 on January 10 (Transaction 6). No interest has been paid on this loan as of January 31 because there is no interest expense recorded in the income statement. However, interest has been accruing on the loans since they were received. The interest needs to be recorded by means of adjusting entry.

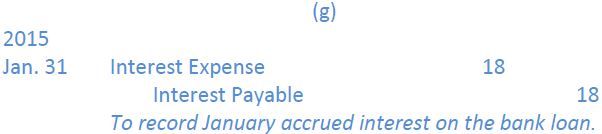

Assume that interest expense amounts to $18. BDCC’s adjusting entry to accrue this expense on January 31 is:

This adjusting entry enables BDCC to include the interest expense on the January income statement even though interest has not yet been paid. The entry also creates a payable that will be reported as a liability on the balance sheet at January 31.

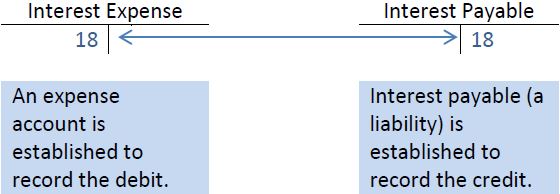

When the adjusting entry is posted, the accounts appear as:

- 4302 reads