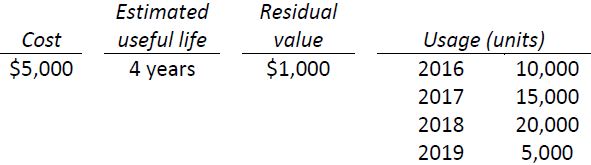

Livingston Corp. purchased printer on January 1, 2016. The company year-end is December 31. The following information is applicable:

|

Required: |

|

|

1. |

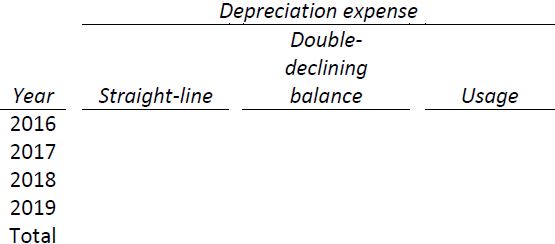

Calculate the depreciation expense for the four-year period under each of these depreciation methods: straight-line, double-declining balance, and usage. Assume the company uses the

½ year rule to calculate depreciation expense in the year of acquisition and disposal where applicable. Present your solution in the following format: |

|

2. |

The president has asked you to describe one factor that might affect depreciation rate and residual value estimates, and how these changes to estimates will be accommodated should they occur. How would you respond? |

|

3. |

Which method of depreciation would you recommend in this case? Why? |

- 1789 reads