Short-term notes receivable were discussed in Chapter 7. A note receivable can arise when an account receivable is overdue and the debtor and creditor agree to enter into a formal legal agreement for payment. A short-term note payable is the flip side of a note receivable. It is an arrangement to formalize repayment of an account from the creditor’s point of view. It is recorded as a current liability if it is expected to be paid within one year from the balance sheet date.

In Chapter 7, BDCC provided $4,000 of services on August 1, 2015 to customer Woodlow. Woodlow was unable to pay this amount in a timely manner. The receivable was converted in BDCC’s accounting records on December 1, 2015 to a 4%, three-month note receivable, meaning that the $4,000 was to be repaid with interest on February 28, 2016.

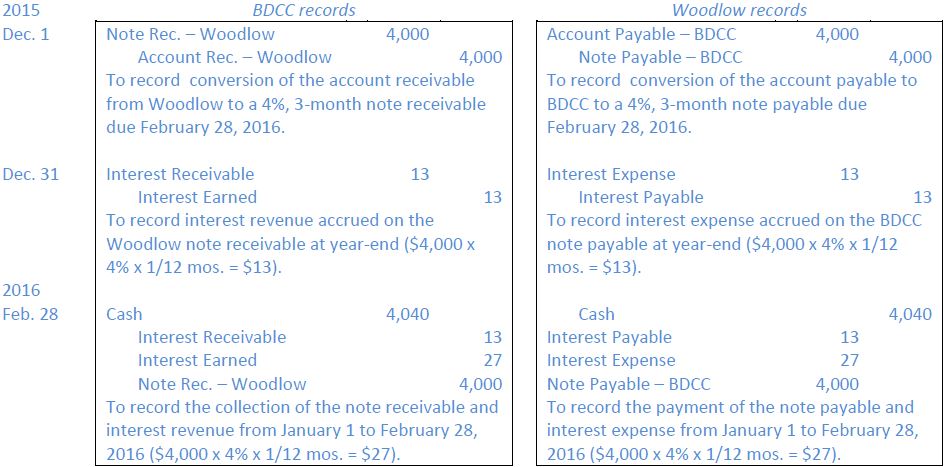

The following example compares the entries recorded by BDCC for the note receivable to the entries recorded by Woodlow to establish and then satisfy a note payable for the same transaction.

Notice that the dollar amounts in the entries for BDCC are mirrors of those for Woodlow. BDCC records interest earned; Woodlow records interest expense. BDCC will report two current assets in its balance sheet at December 31 (note receivable; interest receivable); Woodlow will report two current liabilities (note payable; interest payable).

- 3495 reads