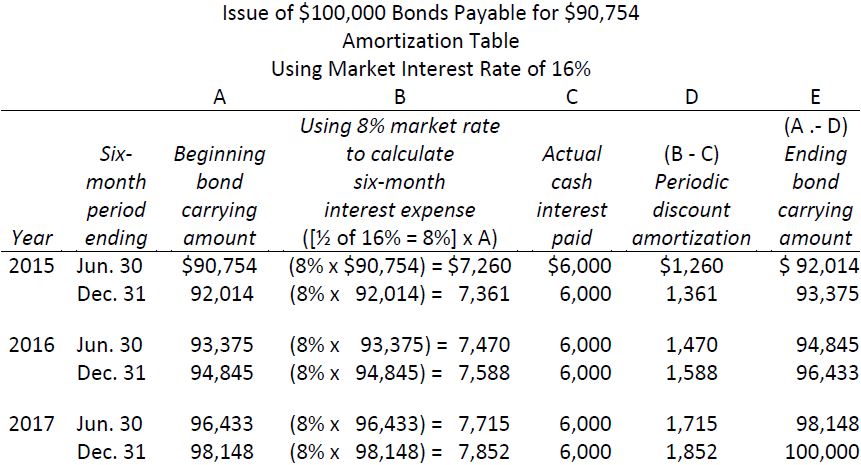

The following amortization table is prepared for the BDCC issue of $100,000 face value bonds at a discount for $90,754. The calculation begins with the $90,754 carrying amount in column A. The objective is to increase this carrying amount to the face value of $100,000 over the three-year life of the bond at a constant interest rate; this increase appears in column E.

The annual market interest rate in this case is 16%. Half this rate — 8% — is used in the column B calculations, since interest payments are made semi-annually. (For convenience, all column B calculations are rounded to the nearest dollar.) The calculation in column D provides the amortization amount. In period 1, for example, the difference between the $7,260 market rate interest expense (column B) and the $6,000 actual bond contract interest paid (column C) determines the discount amortization of $1,260 (column B – column C).

Columns E and A show the increasing carrying amount of the bonds during their three-year life. The effective interest method calculates interest expense at a constant 8% of each period’s bond carrying amount. To achieve this, interest expense (column B) increases each period as the bond carrying amount increases.

- 3269 reads