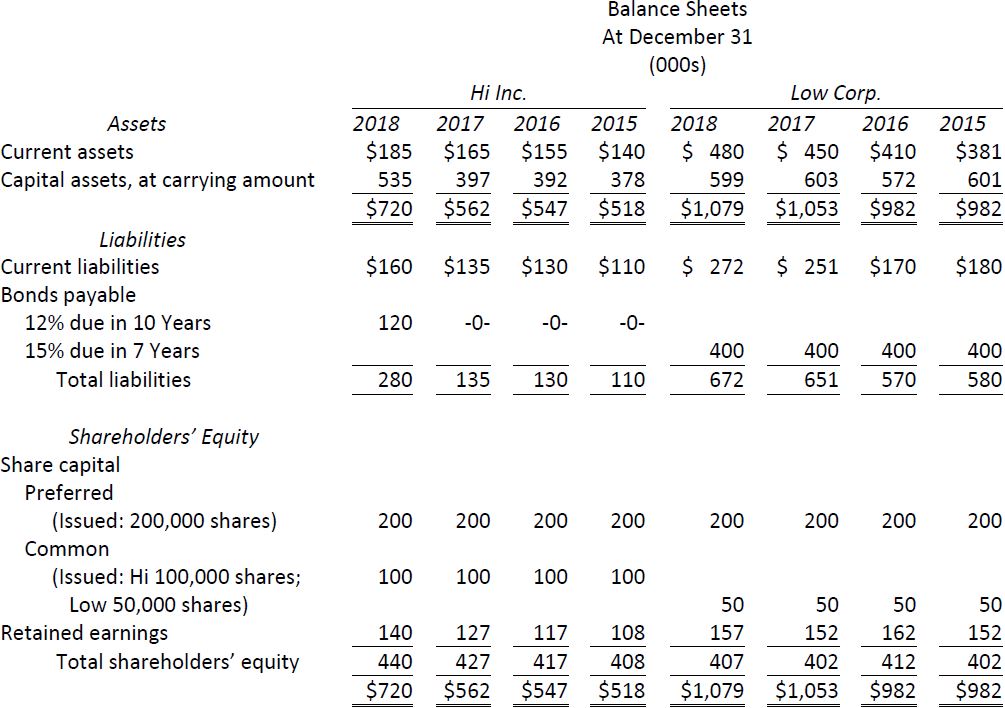

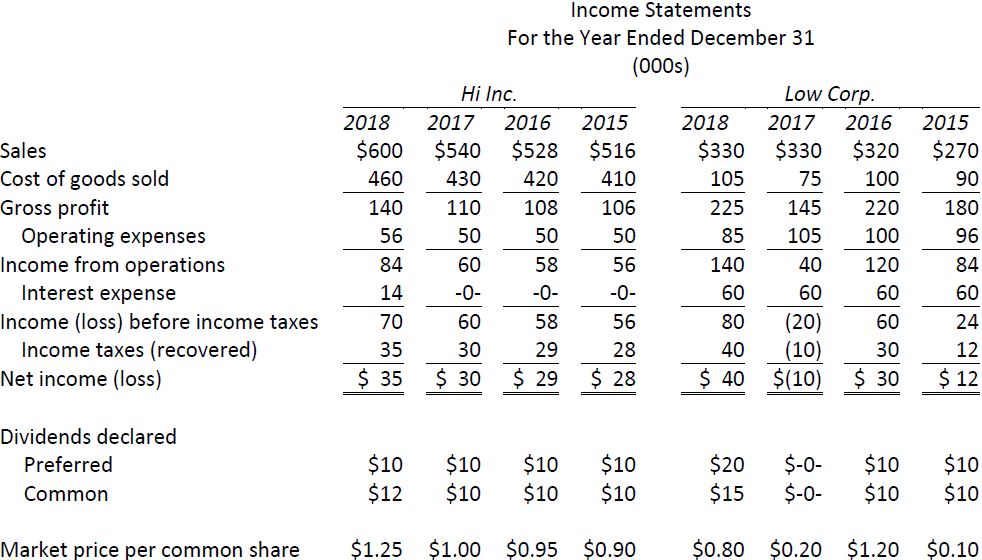

The following are comparative financial statements of Hi Inc. and Low Corp. for the last four years:

|

For discussion: |

||||

|

1. |

a. |

Calculate the following ratios for each corporation for 2016, 2017, and 2018. |

||

|

Current Sales to total assets Return on total assets Return on shareholders’ equity Gross profit Net profit Debt to shareholders’ equity Earnings per share Price-earnings |

||||

|

b. |

Evaluate each company’s trends for sales, gross profit, and net income as disclosed on the income statements. |

|||

|

2. |

What is your evaluation of |

|||

|

a. |

The liquidity of each corporation? |

|||

|

b. |

Profitability? |

|||

|

c. |

The financial structure of each corporation? |

|||

|

d. |

The stock market’s perceptions of these companies? |

|||

|

3. |

Which corporation do you think would be a better investment if you were planning to purchase common shares? |

|||

- 1964 reads