Are BDCC’s sales adequate in relation to its assets? The calculation of the sales to total assets ratio helps to answer this question by establishing the number of sales dollars earned for each dollar invested in assets. The ratio is calculated as:

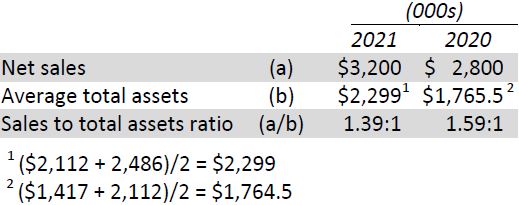

BDCC’s ratios are calculated as follows:

The ratio has decreased from 2020 to 2021. Each $1 of investment in assets in 2020 generated sales of $1.59. In 2021, each $1 of investment in assets generated only $1.39 in sales. Over the same period, BDCC’s investment in assets increased. The ratios indicate that the additional assets are not producing revenue as effectively as in the past. It may be too soon to tell whether the increase in assets in 2020 will eventually create greater sales but an investigation is required.

As noted earlier, comparison with industry averages would be useful. A low ratio in relation to other companies in the same industry may indicate an over-investment in or inefficient use of assets by BDCC. On the other hand, a higher ratio in comparison to other companies would be a positive indicator.

- 2481 reads