Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

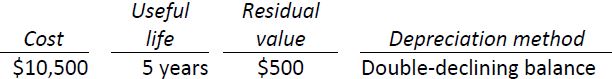

St. Laurent Limited purchased a truck for cash on January 1, 2016. The company’s fiscal year-end is December 31. The company uses the ½ year rule to calculate depreciation in the year of acquisition and disposal. The following details apply:

On March 1, 2017, the company paid $3,500 for gas and oil, a tune-up, new tires, and a battery. It also paid $4,000 to install a lift on the back of the truck. The latter amount is material.

Required:

- Prepare journal entries to record

- the purchase of the truck

- depreciation for 2016

- the 2017 expenditures relating to the truck

- depreciation for 2017.

- Prepare the journal entries to record the sale of the truck on March 3, 2018 for $8,000 cash, including 2018 depreciation expense.

- 1933 reads