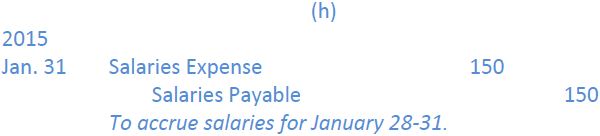

Transaction 9 in Chapter 2 included a $4,000 cash payment for salaries expense. (“Wages” are similar expenses, paid to hourly workers.) Let’s assume that the payments were for work performed by staff only until January 28. There are four days of salary that have not been paid to January 31. Assume this amounts to $150. This additional accrued expense for work done on January 28, 29, 30, and 31 needs to be recorded to appropriately match the salaries expense to the month of January. This is the adjusting entry:

This entry enables the company to include in expense all salaries earned by employees, even though these amounts will not be paid in cash until the next pay period in February. The entry creates an accrued liability for an expense incurred during one accounting period (January) but paid in another accounting period (February).

When the adjusting entry is posted, the accounts appear as follows:

- 2283 reads