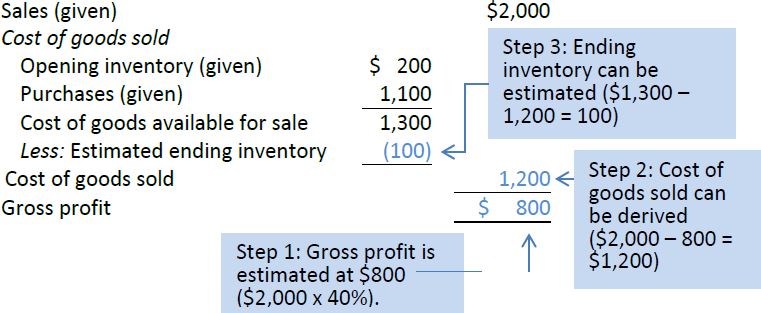

The gross profit method of estimating ending inventory assumes that the percentage of gross profit on sales remains approximately the same from period to period. Therefore, if the gross profit percentage is known, the dollar amount of ending inventory can be estimated. First, gross profit is estimated by applying the gross profit percentage to sales. From this, cost of goods sold can be derived, namely the difference between sales and gross profit. Cost of goods available for sale can be determined from the accounting records (opening inventory + purchases). The difference between cost of goods available for sale and cost of goods sold is the estimated value of ending inventory.

To demonstrate, assume that Pete’s Products Ltd. has an average gross profit percentage of 40%. If opening inventory at January 1, 2019 was $200, sales for the six months ended June 30, 2019 were $2,000, and inventory purchased during the six months ended June 30, 2019 was $1,100, the cost of goods sold and ending inventory can be estimated as follows.

The estimated ending inventory at June 30 must be $100—the difference between the cost of goods available for sale and cost of goods sold.

The gross profit method of estimating inventory is useful in situations when goods have been stolen or destroyed by fire or when it is not cost-effective to make a physical inventory count.

- 3225 reads