Plant and equipment assets are depreciated. Intangible assets are also depreciated but the term used is amortization instead of depreciation. Amortization is the systematic process of allocating the cost of intangible assets over their estimated useful lives. The straight-line method is usually used.

Like PPE, useful life and residual value of intangible assets are estimated by management and must be reviewed annually for reasonableness. As well, any effects on amortization expense because of changes in estimates are accounted for prospectively. That is, prior accounting periods’ expenses are not changed.

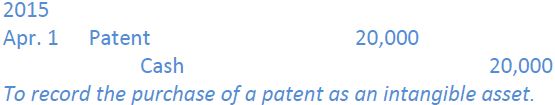

To demonstrate the accounting for intangibles, assume a patent is purchased for $20,000 on April 1, 2015. The entry to record the purchase is:

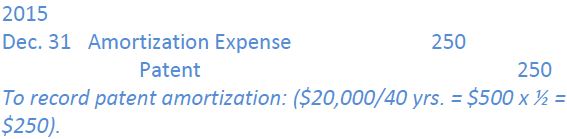

Assuming the patent will last 40 years with no residual value and the ½ year rule applies, amortization expense will be recorded at the December 31, 2015 year-end as:

Notice that the Patent general ledger account is credited and not Accumulated Amortization. There is no accumulated amortization account maintained for intangible assets.

In other respects, impairment losses, and gains and losses on disposal of intangible assets are calculated and recorded in the same manner as for property, plant, and equipment.

- 2667 reads