Usage-based depreciation methods, such as the units-of-production method, are used when the output of an asset varies from period to period.

| Usage methods assume that the asset will contribute to the earning of revenues in relation to the amount of output during the accounting period. Therefore, the depreciation expense will vary from year to year. |

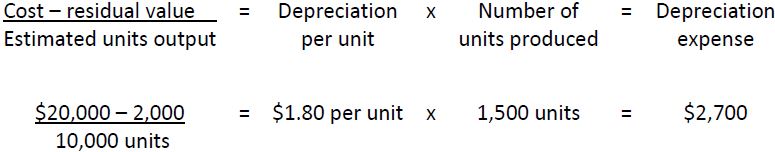

To demonstrate, assume that Big Dog Carworks Corp. purchased a $20,000 piece of equipment on January 1, 2015 with a $2,000 residual value and estimated productive life of 10,000 units. If 1,500 units were produced during 2015, the depreciation expense for the year ended December 31, 2015 would be calculated using the following formula:

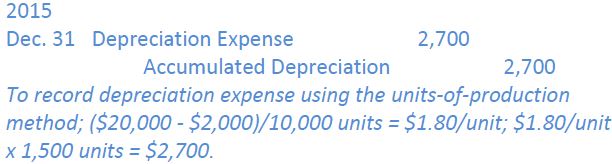

The following adjusting entry would be made on December 31, 2015 :

The carrying amount or net book value of the asset is its cost less accumulated depreciation. On the December 31, 2015 balance sheet, the carrying amount would be $17,300 ($20,000 - 2,700).

| Note that the residual value is only used to calculate depreciation expense. It is not recorded in the accounts of the company or included as part of the carrying amount on the balance sheet. |

If 2,000 units were produced during 2016, depreciation expense for that year would be $3,600 ($1.80 per unit x 2,000 units). At December 31, 2016, the following adjusting entry would be recorded:

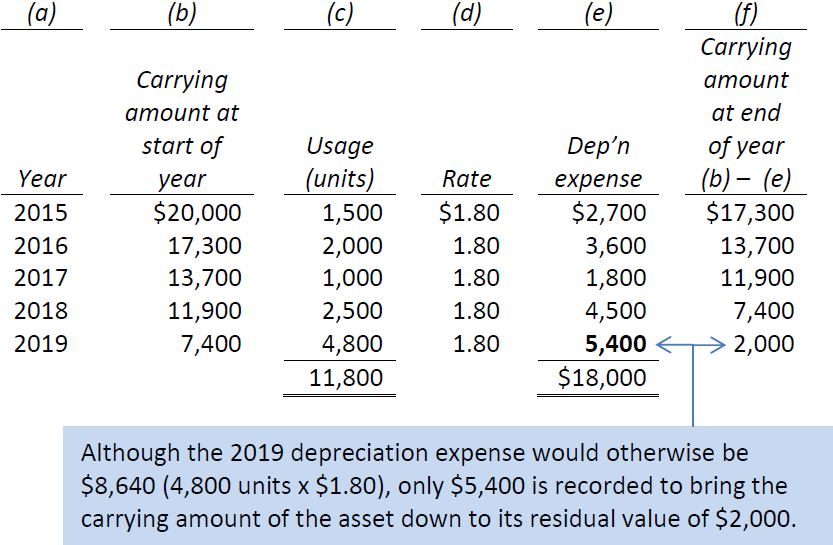

The carrying amount at December 31, 2016 would be $13,700 ($20,000 – 2,700 – 3,600). If the equipment produces 1,000 units in 2017, 2,500 units in 2018, and 3,000 units in 2019, depreciation expense and carrying amounts would be as follows each year:

If the equipment produces exactly 10,000 units over its useful life and is then retired, depreciation expense over all years will total $18,000 (10,000 units x $1.80) and the carrying amount will equal residual value of $2,000 ($20,000 – 18,000).

It is unlikely that the equipment will produce exactly 10,000 units over its useful life. Assume instead that 4,800 units were produced in 2019. Depreciation expense and carrying amounts would be as follows each year:

- 13244 reads