Assume C is going to purchase B’s interest in A and B Partnership, and B will leave. The purchase of an existing partner’s interest in a partnership is a private transaction between the new partner and the applicable existing partner. The new partner C makes a payment to the existing partner B, who in turn transfers the partnership interest. This type of purchase does not affect the assets of the partnership. Only an entry recording the change in ownership is made in the partnership books. The following entry illustrates the recording of C’s purchase of B’s interest.

The balance sheet of the partnership would show the following:

The amount paid by C to B is not reflected in the partnership records. Assume now that C purchased only ½ of B’s interest. In this case, only half of B’s interest would be transferred to C by the following entry:

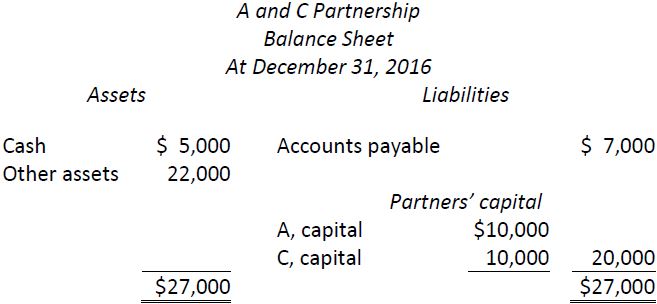

The balance sheet of the partnership would show the following:

- 8681 reads