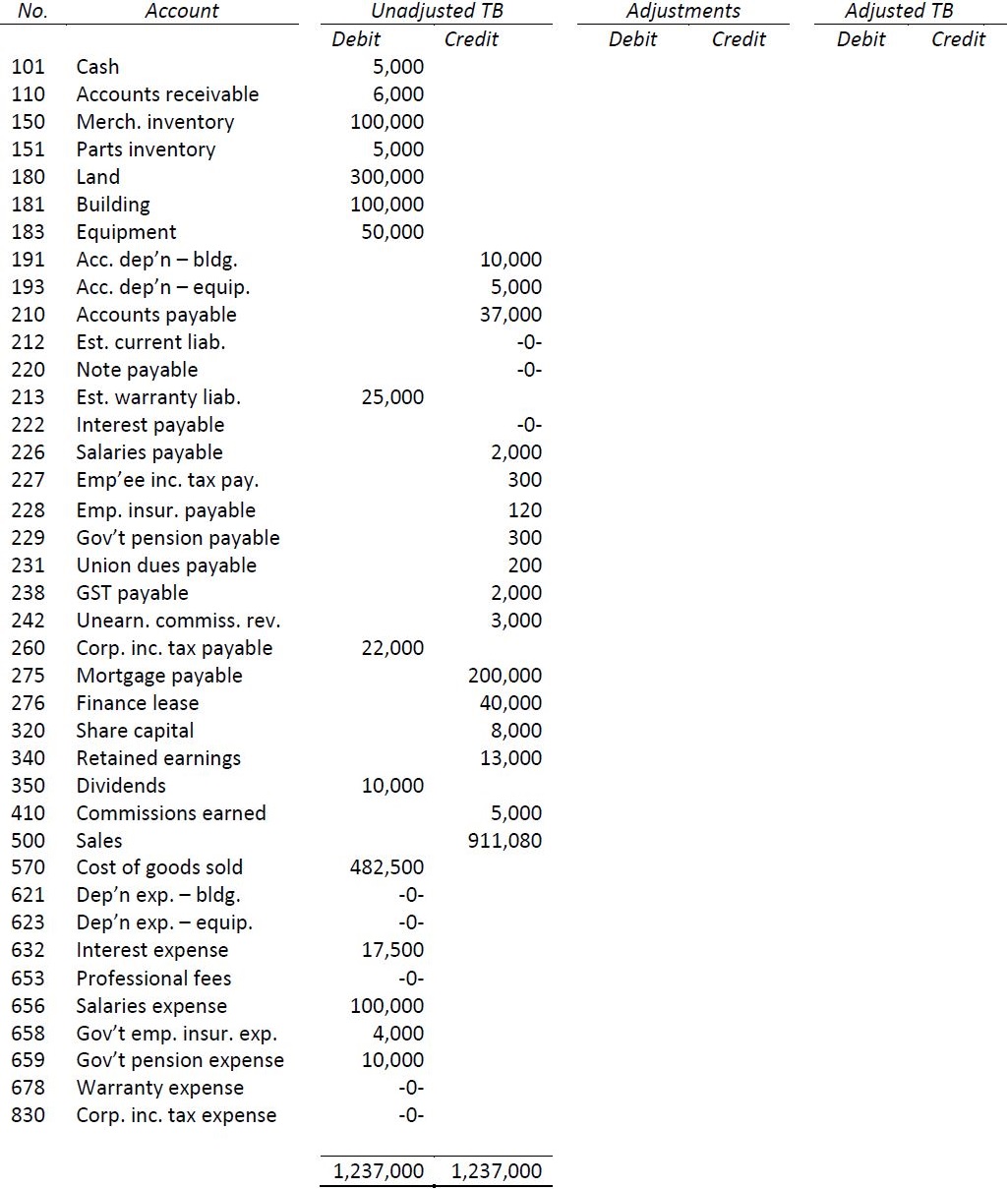

The following unadjusted trial balance has been taken from the records of Grant Retailers Corp. at December 31, 2016:

The following additional information is available at the year-end. GST of 5% only applies when indicated.

|

a. |

Unearned commission revenue should be $5,000. |

||||||

|

b. |

An account payable of $10,000 was converted to a 3% note payable on November 1. The accounting records have not been adjusted yet, nor has any interest been recorded. |

||||||

|

c. |

A $10,000 purchase of merchandize inventory on account plus GST has not been recorded. |

||||||

|

d. |

Warranty expense for the year is estimated at 3% of sales. |

||||||

|

e. |

Additional unpaid gross salaries amount to $6,000. Deductions from gross pay are as follows: |

||||||

|

Employee income taxes |

15% |

||||||

|

Government employment insurance |

2% |

||||||

|

Government pension |

5% |

||||||

|

Union dues |

10% |

||||||

|

The company matches employee contributions to the government employment insurance and government pension plans on a 2 to 1 basis. |

|||||||

|

f. |

Legal fees related to the 2016 financial statements amounted to $8,000 plus GST have been invoiced but amounts have not yet been recorded. |

||||||

|

g. |

Payments on the mortgage and finance lease, including interest, were made on December 1. Payments during 2016 will be made as follows: |

||||||

|

Interest |

Reduction of principal |

Total payments |

|||||

|

Mortgage (6%) |

$11,708 |

$5,385 |

$17,093 |

||||

|

Finance lease (10%) |

3,631 |

6,520 |

10,151 |

||||

|

h. |

It is probable that the company will lose a lawsuit filed against it during the year. The estimated award is $100,000, which likely will be paid in 2017. |

||||||

|

i. |

Depreciation on the building is calculated on the double-declining balance basis. The useful life at acquisition was twenty years, and residual value $10,000. There were no additions or disposals during the year. Depreciation on the equipment is calculated on the straight-line basis. The remaining useful life is two years. Residual value is $10,000. There were no additions or disposals during the year. |

||||||

|

j. |

Audit fees are estimated to be $20,000. |

||||||

|

k. |

The corporate income tax rate is 30% of income before income taxes. Corporate income tax instalments have been made during the year. |

||||||

Required:

- Prepare necessary adjusting entries at December 31, 2016. Include descriptions and general ledger account numbers, and calculations if necessary.

- Post the entries to the worksheet and prepare an adjusted trial balance.

- Prepare a classified income statement and statement of changes in equity for the year ended December 31, and a classified balance sheet at December 31. Consider salary, benefits, and warranty expenses to be selling expenses. No shares were issued during the year.

- Comment on the reasonableness of the estimated warranty expense rate (3% of sales).

- 2495 reads