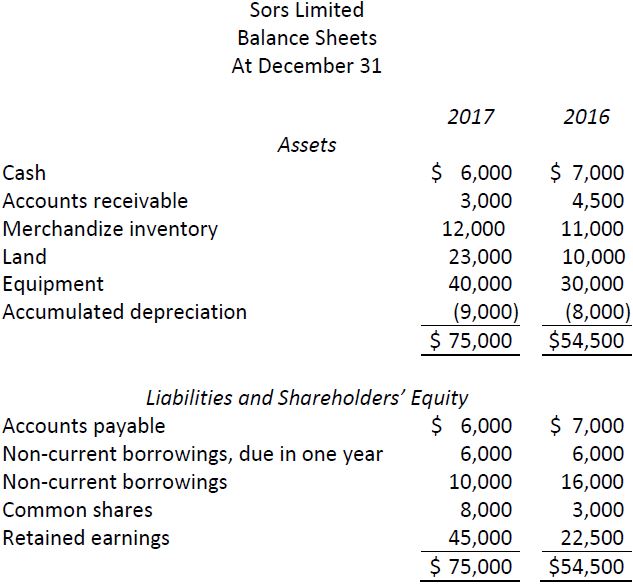

The comparative balance sheets for Sors Limited at December 31 are as follows:

Additional information for 2017:

|

a. |

Net income for the year was $27,500. There were no income taxes. |

|

b. |

No land was sold. |

|

c. |

Equipment was purchased for $20,000 in exchange for common shares valued at $5,000, plus $15,000 cash. |

|

d. |

Equipment costing $10,000 was sold for $12,000 cash; a $4,000 gain was reported in net income. |

|

e. |

Cash dividends of $5,000 were declared and paid. |

|

f. |

Depreciation expense of $3,000 was included in the net income amount. |

Required:

- Prepare a cash flow table for the year ended December 31, 2017.

- Prepare a statement of cash flows.

- What observations about Sors Limited can you make from the SCF?

- 1866 reads