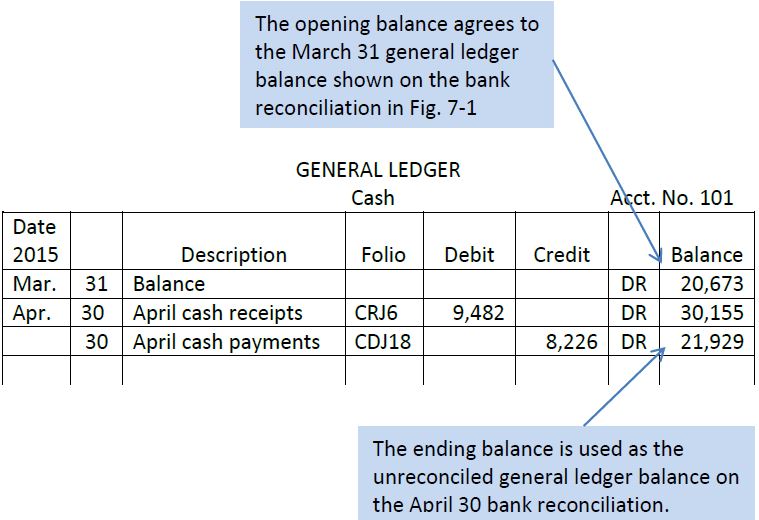

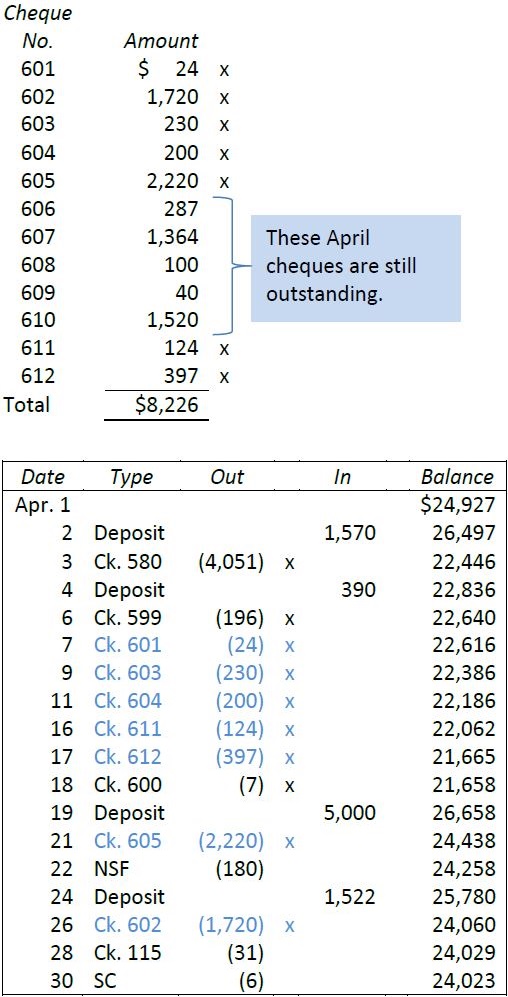

Now, a bank reconciliation will be prepared for BDCC for the next month-end, April 30. The general ledger Cash account shows an opening balance of $20,673 at April 1 (note that this is the amount that is shown in Figure 7.1 as the March 31 ending Cash balance. Assume cash receipts (debits) amount to $9,482 in April and that cash disbursements (credits) amount to $8,226. The ending balance general ledger Cash balance at April 30 is $21,929. The general ledger for April is shown in Figure 7.2.

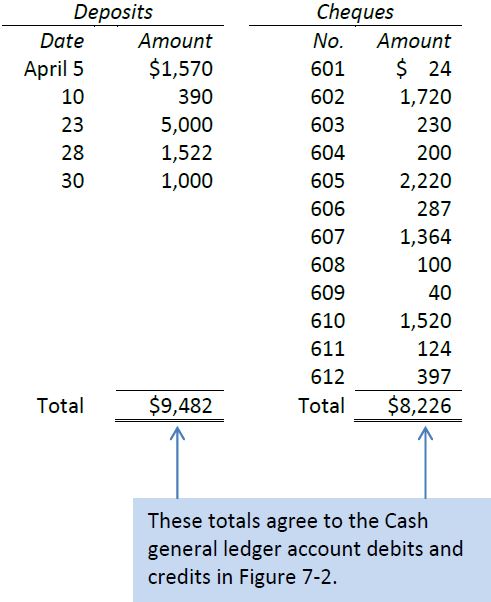

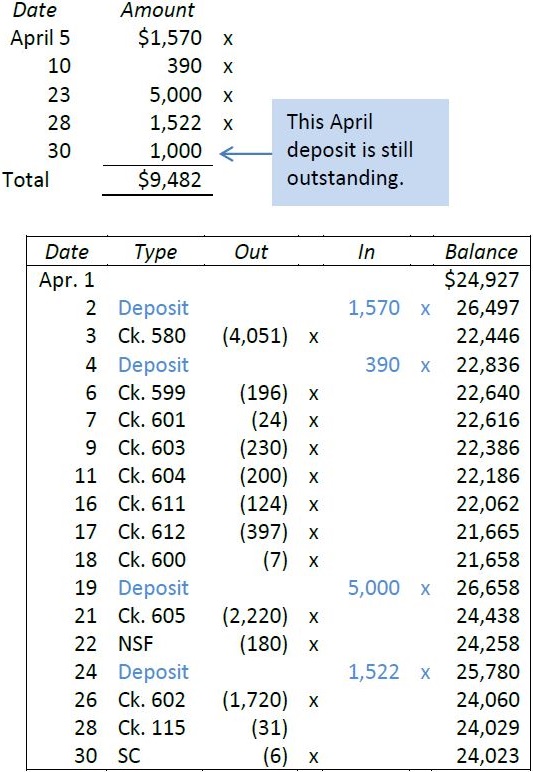

Assume further that April deposits made and cheques issued are as follows:

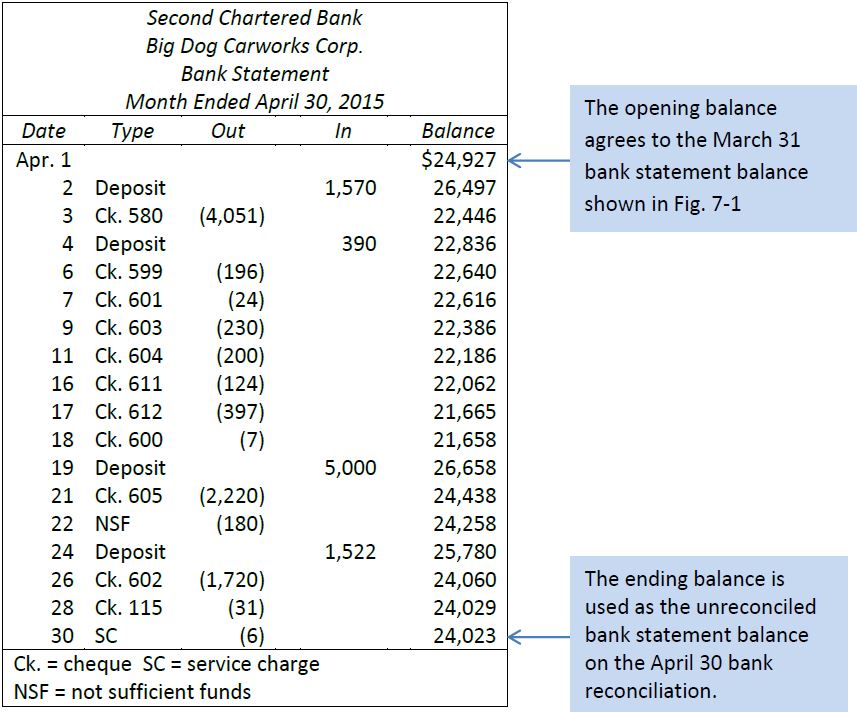

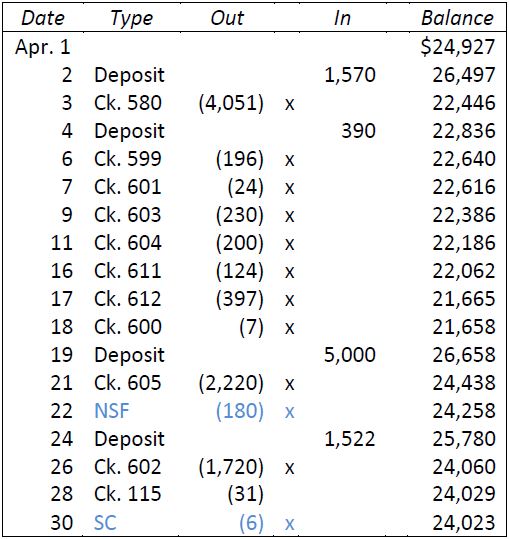

The bank statement issued by BDCC’s bank is as follows:

There are nine steps to follow in preparing a bank reconciliation:

Step 1

List the ending general ledger cash balance ($21,929 from Figure 7.2) on the bank reconciliation as the unreconciled general ledger Cash balance on April 30, similar to that shown in Figure 7.1.

Step 2

List the ending cash balance on the bank statement ($24,023 from Figure 7.3) on the bank reconciliation as the unreconciled bank statement balance on April 30, similar to that shown in Figure 7.1.

Step 3

Compare clearing cheques shown on the bank statement with cheques recorded as cash disbursements in the company’s records.

a. Review the prior month’s bank reconciliation and ensure that outstanding cheques have cleared the bank in the subsequent month.

|

In the company records: These cheques were recorded in March; therefore, the cash balance per the general ledger is correctly stated. In the bank statement: These outstanding March cheques may not have been paid by the bank in April. If some of the cheques have not yet been paid, the bank’s balance is overstated at April 30 by the amount of these cheques. |

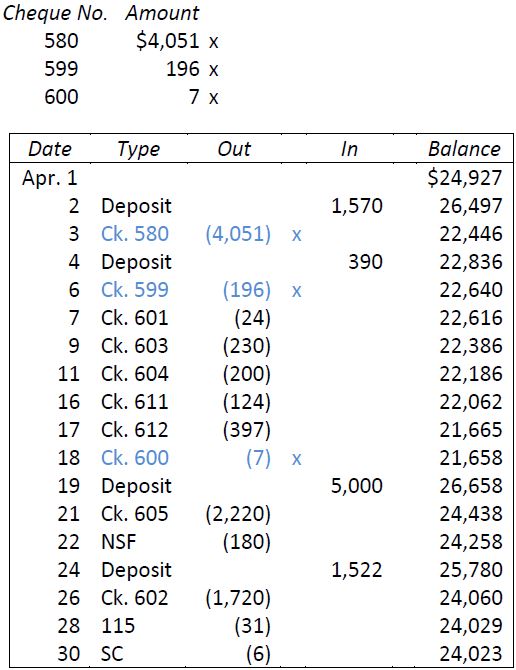

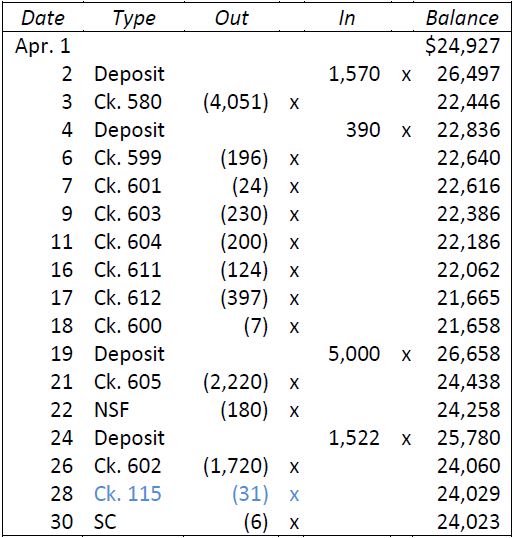

The outstanding cheques on the March 31 bank reconciliation are shown in Figure 7.1 and reproduced below. Cheques clearing the bank are marked with an ‘x’ on the prior month’s outstanding cheque list and on the April bank statement, as follows:

All the March outstanding cheques (# 580, 599, and 600) were paid by the bank in April; no adjustment is required in the April 30 bank reconciliation—the cash balance per the company’s general ledger and the bank statement at April 30 are correctly stated in relation to these March outstanding cheques.

b. Compare the cheques clearing the bank in April with the cheques recorded as April cash disbursements. Cleared items are marked with an ‘x’ on the April cheque list and the April bank statement:

|

In the company records: These cheques were recorded in April; therefore, the general ledger Cash balance is correctly stated. In the bank statement: These outstanding cheques were not paid by the bank in April. Therefore, the unreconciled bank balance on April 30 of $24,023 is overstated. |

The outstanding cheques must be deducted from the unreconciled bank statement balance on the bank reconciliation.

Step 4

Other disbursements made by the bank but not recorded in the company records are identified and marked with an ‘x’.

a. An examination of the April bank statement shows that the bank had deducted the NSF cheque of John Donne for $180.

|

In the company records: The cheque of John Donne had originally been recorded as a cash receipt (a payment on account). During April, no entry was made regarding this returned cheque; therefore, the cash balance in the general ledger is overstated at April 30. In the bank statement: The bank has already made a deduction from the cash balance shown on the bank statement for this NSF cheque. |

In reconciling the cash balances shown in the general ledger and on the bank statement, this returned cheque must be deducted from the unreconciled general ledger Cash balance of $21,929 shown on the bank reconciliation. It also should be set up as an account receivable and a notice should be sent to Donne requesting payment again. The journal entry to do this will be discussed below.

b. An examination of the April 30 bank statement also shows that the bank has deducted a service charge of $6 during April.

|

In the company records: This service charge was not deducted from the cash balance in the general ledger during April. Therefore, the cash balance is overstated at April 30. In the bank statement: The service charges have already been deducted from the cash balance shown on the bank statement. |

To reconcile the cash balance in the company records with the bank statement, this service charge must be deducted from the unreconciled general ledger Cash balance shown on the bank reconciliation.

Step 5

The April deposits shown on the bank statement are compared with the amounts recorded in the company general ledger Cash account and marked with an ‘x’ on each document.

This comparison indicates that the April 30 cash receipt amounting to $1,000 has not yet been included as a deposit in the bank statement.

|

In the company records: The April cash receipts have been recorded correctly. In the bank statement: The April cash receipts have been deposited and recorded on the bank statement, except for the April 30 deposit. |

To reconcile the cash balance in the company records with the bank statement, the outstanding deposit must be added to the bank statement ending cash balance of $24,023 on the bank reconciliation.

Step 6

The March bank reconciliation is reviewed for outstanding deposits at March 31.

|

In the company records: The cash receipts for March have all been recorded in the general ledger. In the bank statement: Any outstanding deposits at March 31 should have been recorded by the bank in April. If any March deposits are outstanding at April 30, this should be investigated. |

There were no outstanding deposits at March 31 according to the prior month’s bank reconciliation, so no adjustments are needed. If a prior month’s deposit is still outstanding at next month-end, the bank should be notified. This is an unusually long time for a deposit to not appear on the bank statement. The outstanding deposit should be added to the unreconciled bank statement balance on the bank reconciliation.

Step 7

Any errors in the company records or in the bank statement that become apparent during the reconciliation process must be rectified. On the bank statement, these items should not yet have an ‘x’ by them.

An examination of the April bank statement shows that the bank deducted a cheque issued by another company for $31 from the BDCC bank account in error. (Assume that when notified, the bank indicated it would make a correction in May’s bank statement.)

|

In the company records: This cheque does not belong to Big Dog and does not require any change in its accounting records. In the bank statement: The cheque should not have been deducted from Big Dog’s bank account. Therefore, the cash balance shown on the bank statement balance on the April 30 bank reconciliation is understated. |

To reconcile the cash balance in the company records with the bank statement, the cheques deducted in error must be added to the unreconciled bank statement balance of $24,023shown on the bank reconciliation.

Step 8

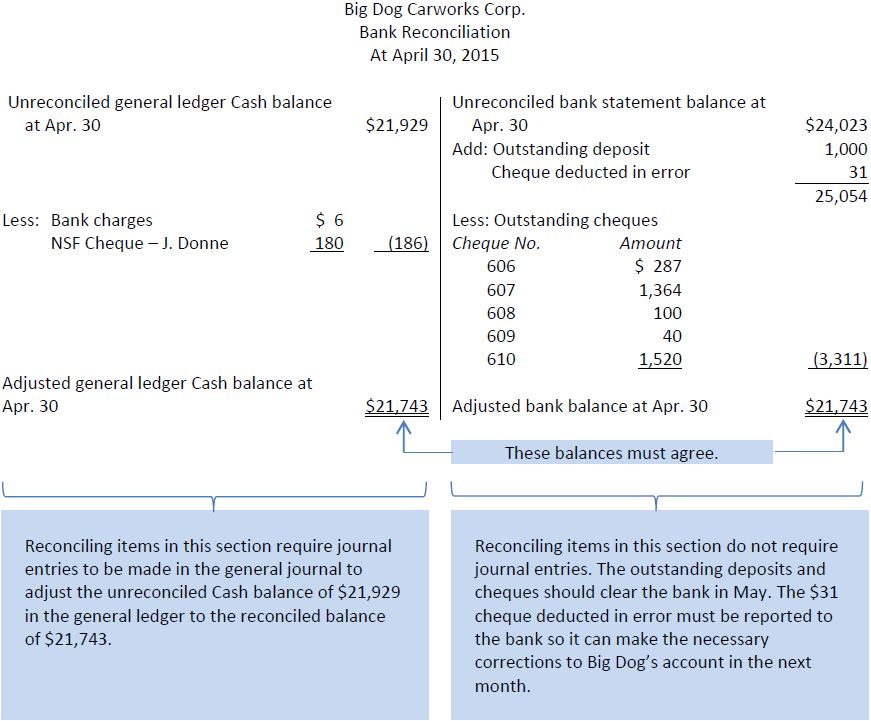

Total both sides of the bank reconciliation. The result should be that the reconciled general ledger Cash balance and the bank statement balances are equal. The completed bank reconciliation is shown in Figure 7.4.

Step 9

The adjusted balance of $21,743 calculated in the bank reconciliation must be reflected in the company’s general ledger Cash account. Adjusting entries must be prepared. The adjusting entries are based on the reconciling item on the left-hand side of the bank reconciliation and are as follows:

Big Dog does not make any adjusting entries for the reconciling items on the right (bank) side of the bank reconciliation since these items should eventually clear the bank or be corrected by the bank and appear on a later month’s bank statement.

- 10403 reads