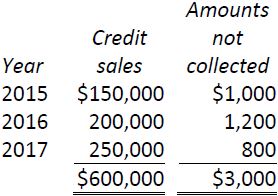

The objective of the income statement method is to estimate bad debt expense based on credit sales. Bad debt expense is calculated by applying an estimated loss percentage to credit sales for the period. The percentage is typically based on actual losses experienced in prior years. For instance, a company may have the following history of uncollected sales on account:

The average loss over these years is $3,000/$600,000, or ½ of 1%. If management anticipates that similar losses can be expected in 2018 and credit sales for 2018 amount to $300,000, bad debts expense would be estimated as $1,500 ($300,000 x 0.005).

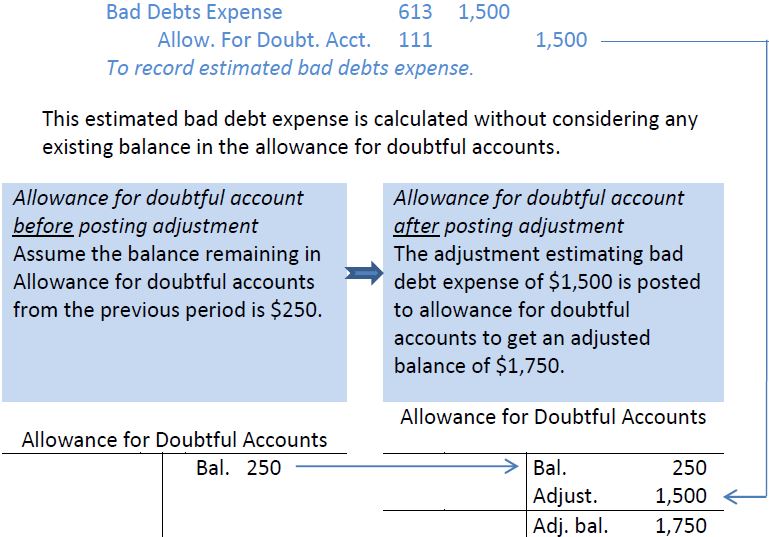

Under the income statement method, the $1,500 represents estimated bad debt expense and is recorded as:

- 2719 reads