Some investors’ primary objective is to maximize dividend revenue from share investments, rather than realize an increasing market price of the shares. This type of investor is interested in information about the earnings available for distribution to shareholders and the actual amount of cash paid out as dividends rather than the market price of the shares.

The dividend yield ratio is a means to determine this. It is calculated as:

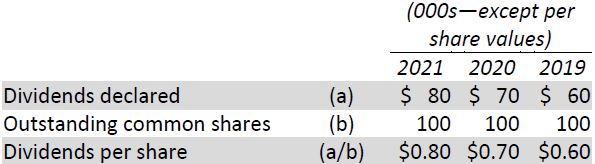

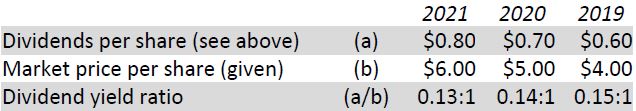

This ratio indicates how large a return in the form of dividends can be expected from an investment in a company’s shares. The relevant information for BDCC over the last three years is shown in the financial statements, as follows:

The dividend yield ratio is therefore:

The company’s dividend yield ratio decreased from 2019 to 2021. In 2019, investors received $0.15 for every $1 invested in shares. By 2021, this had decreased to $0.13 for every $1 invested. Though the decline is slight, the trend may concern investors who seek steady cash returns. Also notice that total dividends declared increased from 2019 to 2021 even though net income did not substantially increase, and despite the company’s poor liquidity position noted earlier. Investors might ask why such high levels of dividends are being paid given this situation.

- 1957 reads