An accelerated depreciation method assumes that a capital asset will contribute more to the earning of revenues in the earlier stages of its useful life than in the later stages. This means that more depreciation is recorded in earlier years with the depreciation expense decreasing each year. This approach is most appropriate where assets experience a high degree of obsolescence (such as computers) or where the value of the asset is highest in the first years when it is new and efficient and declines significantly each year as it is used and becomes worn (such as mining equipment).

| Under an accelerated depreciation method, depreciation expense decreases each year over the useful life of the asset. |

One type of accelerated depreciation is the double-declining balance(DDB) method. To calculate, the percentage cost of the asset (100%) is divided by its estimated useful life, without regard to residual value. The resulting rate is doubled. The doubled rate is applied at the end of each year to the carrying amount of the asset.

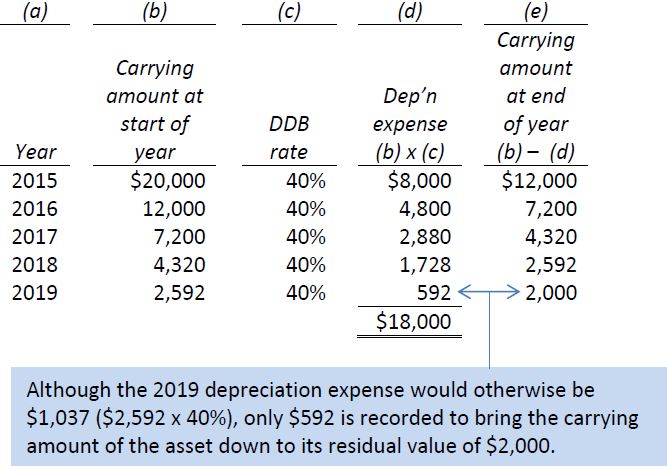

For example, assume the same $20,000 equipment with an estimated useful life of five years. The straight-line rate is 20 per cent, calculated by dividing 100 per cent by five years, the useful life (100%/5 = 20%). This straight-line rate of 20% is then doubled to 40%.

Regardless of which depreciation method is used, a capital asset cannot be depreciated below its carrying amount, which in this case is $2,000. The DDB depreciation for the five years of the asset’s useful life follows:

- 3353 reads