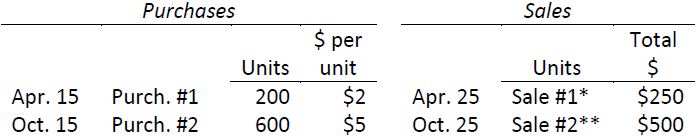

The following sales and purchases of the same product were made during 2018 at Yang Corporation. The opening inventory consisted of 50 units at $1 each.

*for specific identification, sold 50 units of opening inventory and 200 units of purchase #1

**for specific identification, sold 500 units of purchase #2

Required:

1. Calculate cost of goods sold and the cost of ending inventory under each of FIFO, specific identification, and weighted average inventory cost flow assumptions. Set up a table as follows:

|

Purchased |

Sold |

Balance in inventory |

|||||||

|

Date |

Units |

Unit cost |

Total $ |

Units |

Unit cost |

Total $ |

Units |

Unit cost |

Total $ |

|

50 |

$1 |

$50 |

|||||||

2. Prepare calculations comparing the effect on gross profit of the three inventory cost flow assumptions.

3. The president wants to maximize the company’s net income this year. What would you suggest that is in accordance with GAAP?

- 1943 reads