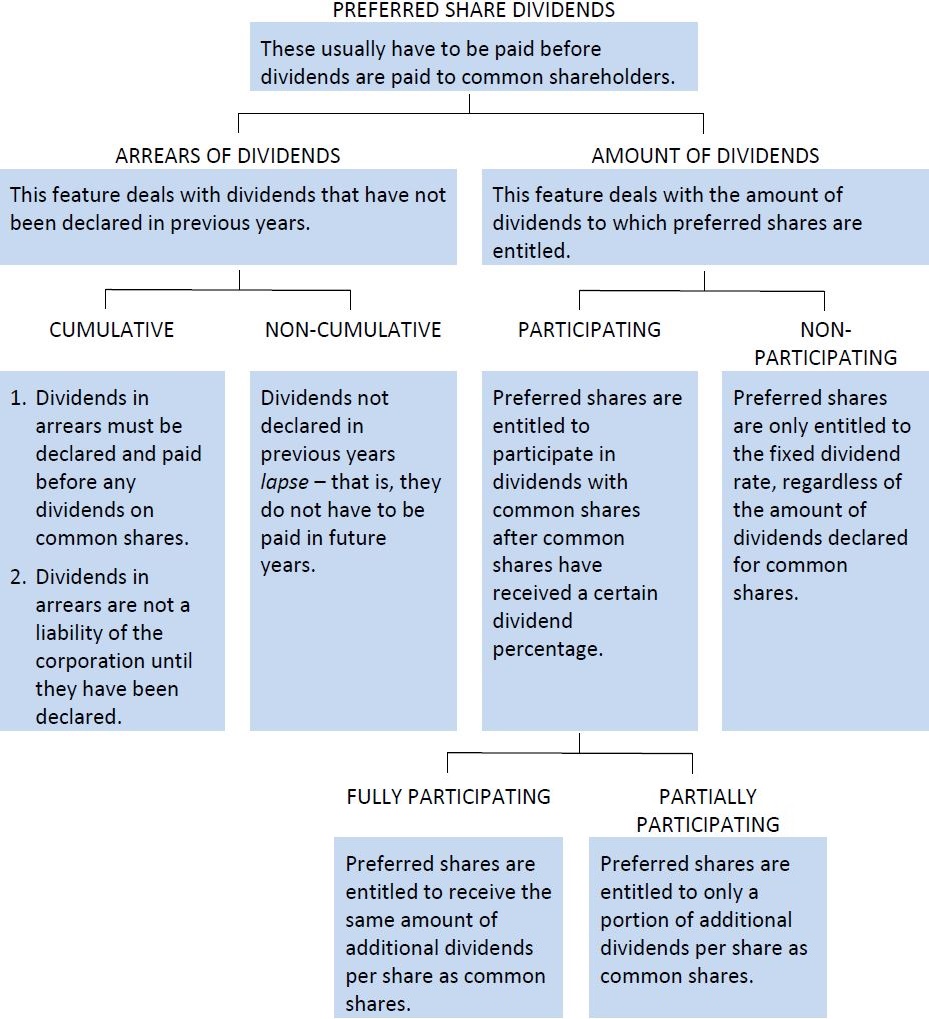

A participating feature is sometimes added to preferred shares to make them more attractive to investors. Under certain circumstances, this feature permits the preferred shares to receive a portion of the earnings of the corporation in excess of a stipulated rate. The extent of this participation can be limited (partially participating) or unlimited(fully participating). Non–participating preferred shares do not receive a share of additional dividends.

The relationship among these preferred share characteristics is shown in Figure 11.4 below:

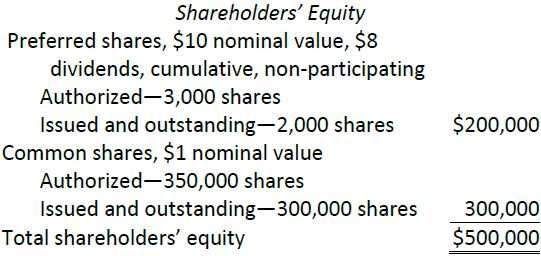

Assume that Bernard Williams Inc. declared dividends totalling $92,000 when the shareholders’ equity section of its balance sheet disclosed the following information:

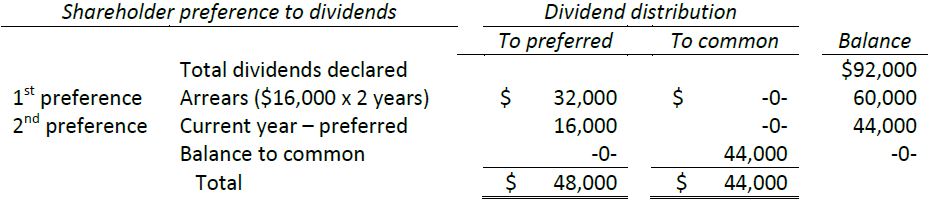

A note to the balance sheet indicates that there are two years of preferred dividends in arrears. If a $92,000 cash dividend declared, the preferred shares are entitled to $16,000 dividends per year (2,000 shares x $8) whenever dividends are declared. Because these shares have a cumulative preference, they are also entitled to dividends in arrears. The dividend distribution would be calculated as:

The cumulative preference has resulted in the payment to preferred shareholders of dividends unpaid in the previous two years; this amounts to $32,000. For the current year, preferred shareholders receive another $16,000 for a total of $48,000. Because the preferred shares are non-participating, the remainder of the $92,000 dividend ($44,000) is paid to common shareholders.

- 3779 reads