Extending credit to customers results in increased sales and therefore profits. However, there is a risk that some accounts receivable will not be collected. A good internal control system is designed to minimize bad debt losses. One such control is to permit sales on account only to credit-worthy customers; this can be difficult to determine in advance. Companies with credit sales realize that some of these amounts may never be collected. These uncollectible accounts, commonly known as bad debts, are an expense associated with selling on credit.

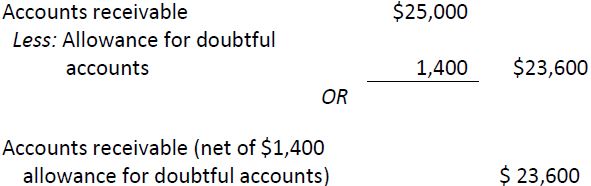

Bad debt expenses should be matched to the credit sales of the same period. For example, assume BDCC recorded a $1,000 credit sale to XYA Company in April, 2015. Assume further that in 2016 it was determined that the $1,000 receivable from XYA Company would never be collected. The bad debt arising from the credit sale to XYA Company should be matched to the period in which the sale occurred, namely, April, 2015. But how can that be done if it is not known which receivables will become uncollectible until a future date? A means of estimating and recording the amount of sales that will not be collected in cash is needed. This is done by establishing a contra current asset account called Allowance for Doubtful Accounts in the general ledger to record estimated uncollectible receivables. This account is a contra account to accounts receivable and is disclosed on the balance sheet as shown below using assumed values.

The Allowance for Doubtful Accounts contra account reduces accounts receivable to the amount that is expected to be collected—in this case, $23,600.

- 2229 reads