Each partner has an individual account that is credited with capital contributions to the partnership. The following entry records a $5,000 cash contribution by partner A.

If non–cash assets are contributed, then the appropriate asset account is debited instead of cash.

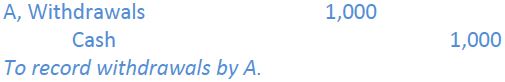

Partner withdrawals of assets from the partnership are recorded in each partner’s withdrawals account. If partner

A withdraws $1,000 cash, for example, the following entry is recorded:

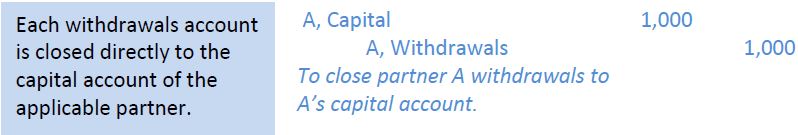

At year-end, each partner’s withdrawals account is closed to their capital account. The following closing entry would close partner A’s withdrawals account, assuming no further withdrawals have been made.

If a partner withdraws any asset, including cash for personal use, the withdrawals account is debited for the cost of the asset and the appropriate asset account is credited for the same amount. For example, if partner A takes a dress from the business with a cost of $20 and a selling price of $100, the journal entry will be:

If an owner uses the business’s funds to pay personal debts, the withdrawals account is again debited. For example, if partner B writes a cheque drawn on the partnerships’ bank account for $35 to pay for his child’s swimming lessons, the journal entry will be:

- 2474 reads