Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

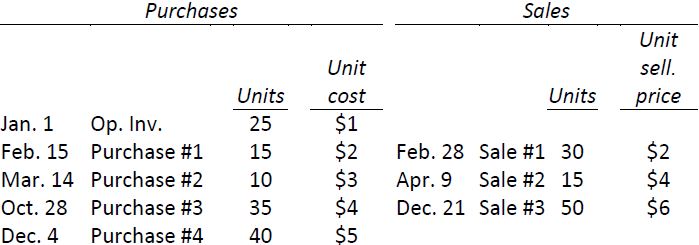

Palermo Inc. uses the perpetual inventory system. All sales are made on account. The following data are taken from the company’s for the year ended December 31, 2018:

Required:

- Show the journal entries to record the December 21 sale under a) FIFO and b) weighted average inventory cost flow assumptions.

- Calculate the amount of gross profit for the year under FIFO and weighted average inventory cost flow assumptions. Which method matches cost of goods sold more closely with revenues? Why?

- Given your answer to (2), what inventory cost flow assumption would be picked if management wanted to minimize income taxes?

- 1882 reads