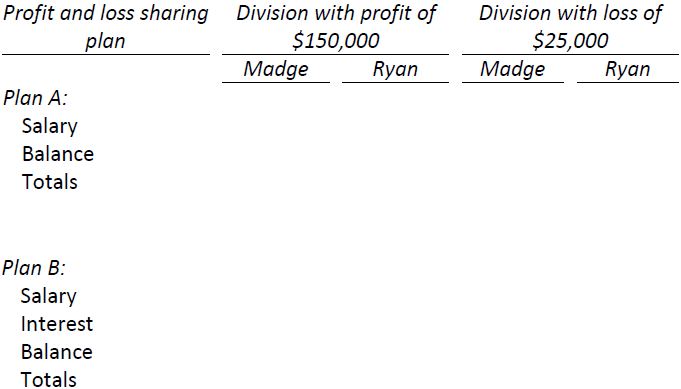

Madge and Ryan have decided to open a business partnership. Madge is familiar with the business and is expected to spend a good deal of time running it. Ryan, on the other hand, will handle the financial duties of the partnership. The following plans for sharing profits and losses are being considered:

|

Plan A |

Salary, with balance of net income or net loss divided equally. Madge’s salary: $10,000 per year; Ryan’s salary: zero. |

|

Plan B |

Salary, interest on investment and balance of net income or net loss split equally: Madge’s salary: $10,000 per year, Ryan’s salary: zero; both to receive 10 per cent per year interest on beginning investments. Beginning investments: Madge: $50,000, Ryan: $200,000. |

|

Required: |

|

|

1. |

Calculate the division under each plan in the schedule below assuming (a) a profit for the year of $150,000, and (b) a loss of $25,000. |

|

2. |

Assume you are Ryan’s financial advisor? What plan would you recommend? |

- 1779 reads