As noted earlier, recurring expenditures that relate to day-to-day servicing of depreciable assets are not capitalized, but rather are expensed when incurred. Oil changes and new tires for vehicles are examples of recurring expenditures that are expensed. Expenditures that are material, can be reliably measured, and enhance the future economic benefit provided by the asset are added to the cost of the asset rather than being expensed when incurred. Subsequent capital expenditures can take two forms:

- Additions (for example, adding new room in an existing building or regular inspection costs of a capital asset)

- Replacement (for example, replacing the engine in a truck or putting new windows in a building).

Additions to existing depreciable assets affect future depreciation expense in the same manner as changes in accounting estimates discussed above. Recall our original example: Equipment is purchased on January 1, 2015 for $20,000. It has a useful life of five years and a residual value of $2,000. It is depreciated on the straight-line basis and using the half-year rule. Assume that a $5,000 device is added to the equipment on January 10, 2018 to reduce pollution emissions. Further, assume that the addition of the device will increase the residual value of the equipment to $3,000 but will not extend its useful life. The journal entry to record the addition is:

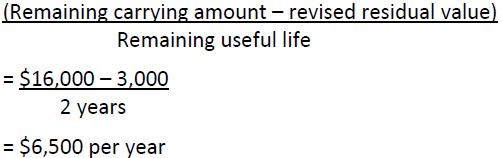

The carrying amount of the equipment at December 31, 2018 prior to calculating depreciation expense is $16,000 ($20,000 – 1,800 – 3,600 – 3,600 + 5,000. Depreciation expense for 2018 and 2019 will be $6,500, calculated:

Note that the ½ year rule does not apply to additions to existingdepreciable assets.

At the end of December 31, 2019, the carrying amount will equal the revised residual value of $3,000 ($20,000 – 1,800 – 3,600 – 3,600 + 5,000 – 6,500 – 6,500).

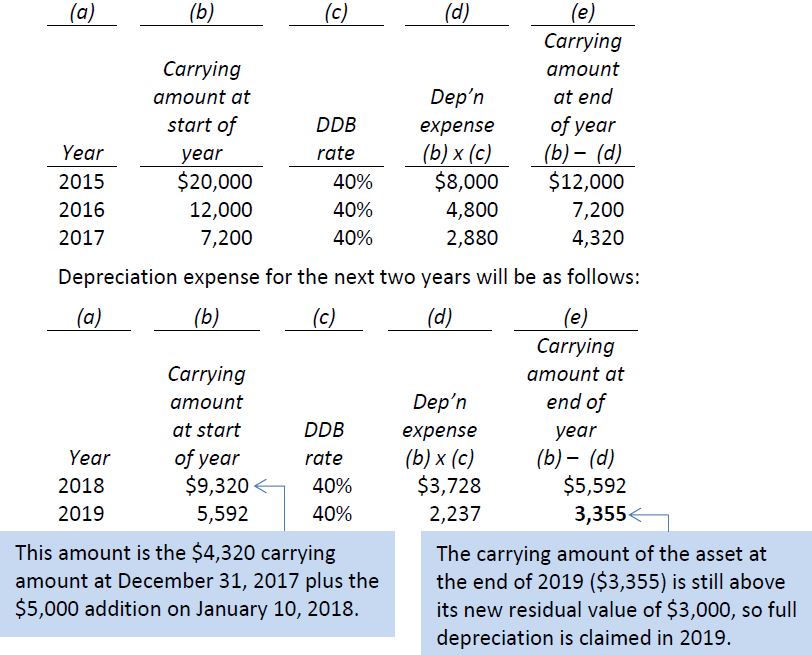

If the double-declining balance method of depreciation is used, the same calculation is performed as before. In our example, the 2018 carrying amount using the double-declining balance method and prior to the additional $5,000 capital expenditure is $4,320, as follows:

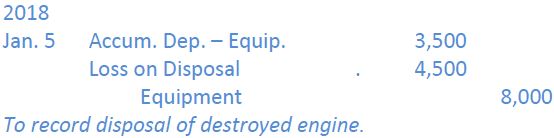

The accounting for a replacement part of a depreciable asset is more involved. The cost of the replaced item and its related accumulated depreciation must be removed from the accounting records when the replacement is capitalized. A gain or loss on disposal must be calculated. Let’s demonstrate, again using our original examples: $20,000 equipment purchased on January 1, 2015 with a five-year useful life and $2,000 residual value. Assume that on January 5, 2018 the engine in the equipment burned out and needed to be replaced. Detailed records of the equipment showed that the engine had an original cost of $8,000, useful life of five years, and residual value of $1,000 resulting in a carrying amount as at January 5, 2018 of $4,500.

The entry to dispose of the old engine and remove it from the accounting records is:

Notice in the entry above that the cost of the old engine and the accumulated depreciation must be individually removed from the general ledger accounts. Losses (as well as gains) are reported on the income statement as Other Revenues and Expenses.

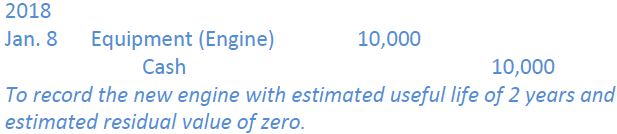

Now assume that a replacmeent engine was intalled on January 8 for $10,000 and had a useful life of two years. The revised residual value of the entire piece of equipment is now $4,000. The entry to record the new engine is:

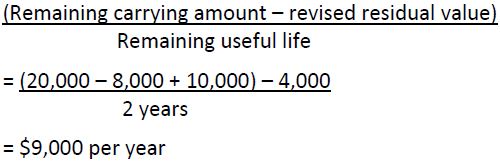

The revised depreciation for 2018 is calculated in the same was as an addition:

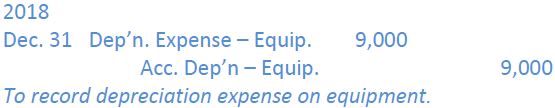

As with additions, the ½ year rule does not apply to replacements. The adjusting entry at December 31, 2018 to record depreciation expense is:

- 5512 reads