The internal control procedures for cash transactions in the Gallagher Corporation were inadequate. Sam Sly, the cashier/bookkeeper, handled cash receipts, made small disbursements from petty cash, maintained accounting records, issued and signed cheques, and prepared the monthly reconciliations of the bank account. At November 30, 2019, the bank statement showed a balance of $17,500. The outstanding cheques were as follows:

|

Cheque No. |

Amount |

|

7062 |

$268.55 |

|

7183 |

170.00 |

|

7284 |

261.45 |

|

8621 |

175.19 |

|

8623 |

341.00 |

|

8632 |

172.80 |

There was also an outstanding deposit of $3,347.20 at November 30.

The balance in the general ledger Cash account at November 30 was $20,258.31, which included some cash on hand. The bank statement for November included $200 arising from the collection of a note receivable; the company’s general ledger did not include an entry to record this collection.

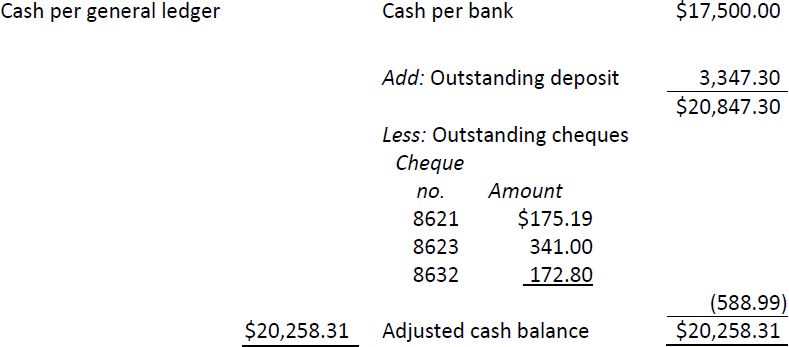

Recognising the weakness existing in internal control over cash transactions, Sly prepared the following bank reconciliation and then wrote a cheque to himself, which he cashed:

Required:

- Calculate the amount of cash taken by Sly.

- Explain how Sly attempted to conceal his theft of cash.

- 2193 reads