A bond issue can also be retired in whole, or in part, before its maturity date. As discussed above, there are several different possibilities:

- The bonds can be repurchased on the open market if the purchase is financially advantageous to the issuer.

- A call provision is sometimes included in a bond indenture permitting early redemption at a specified price, usually higher than face value. The issuer may decide to exercise this call provision if it is financially advantageous.

- The bondholder may be able to exercise a conversion provision if one was provided for in the bond indenture; in this case, the bonds can be converted into specified shares at the option of the bondholder.

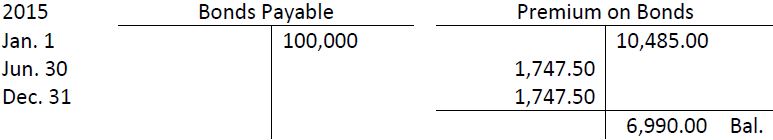

Whenever bonds are retired before their maturity date, the amount payable to bondholders is the face amount of the bonds or the amount required by the call provision. Any unamortized premium or discount must be removed from the accounts. The accounting required for BDCC’s January 1, 2015 issue of $100,000, 12% bonds has been illustrated. Suppose that ½, or $50,000 of face value bonds, are redeemed for cash at 102 (that is, for $50,000 x 102% = $51,000) on December 31, 2015, when the account balances are as follows:

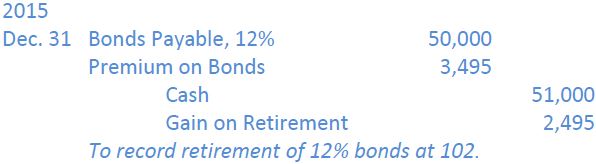

Since $50,000 of the bonds is redeemed, only half of the $6,990 premium balance ($3,495) is removed from the accounting records. The journal entry would be:

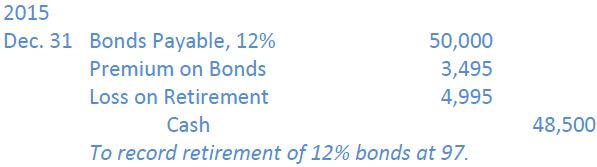

In this case, retirement results in a gain. Under different market conditions, a loss may result. If ½ of the outstanding bonds are redeemed at 97, cash of $48,500 would be received ($50,000 x 97%) and this journal entry would be recorded:

The BDCC retirement occurred on an interest payment date, December 31, 2018. If the retirement had occurred between interest payment dates, accrued interest also would be paid to the bondholders (this will be covered below) and the proportionate write-off of the remaining premium or discount would be recorded at that date.

- 2160 reads