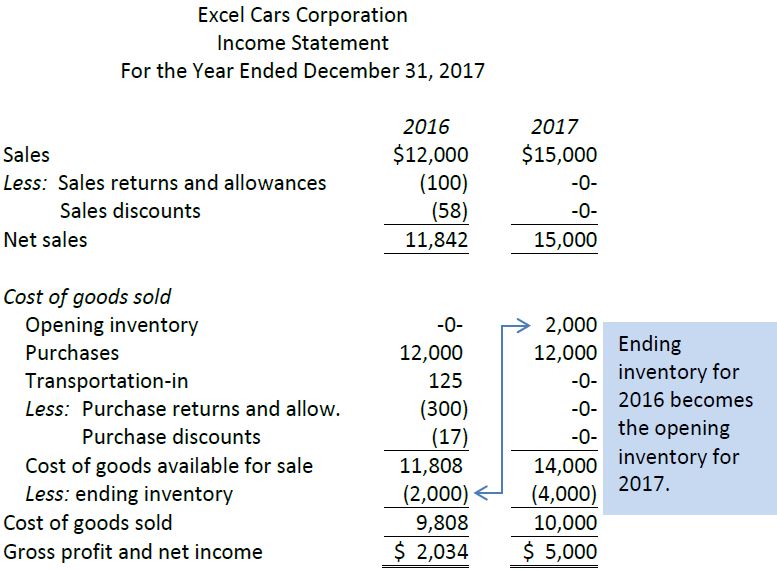

Under the periodic inventory system, the ending inventory of one accounting time period becomes the opening inventory of the next accounting time period. Opening inventory is added to purchases each period and ending inventory is deducted to calculate cost of goods sold.

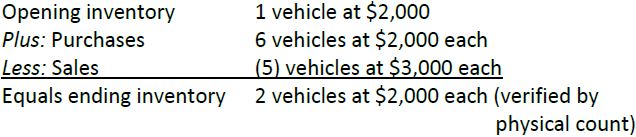

Assume that Excel Cars Corporation had the following transactions in 2017, its next accounting year:

Journal entries are omitted in this example. The gross profit and net income calculations disclosed on the income statement for 2016 and 2017 are shown below. Note that the ending inventory at December 31, 2016 becomes the opening inventory at January 1, 2017.

In 2017, seven vehicles are available for sale – one remaining from 2016 and now included as opening inventory at January 1, 2017 plus six purchased in 2017. Cost of goods available for sale therefore equals $14,000 for the 2017 fiscal year (7 x $2,000). Two vehicles are not sold so are shown as ending inventory at the end of 2017. Their total cost of $4,000 is deducted from cost of goods available for sale to arrive at cost of goods sold for 2017 of $10,000. As was done on 2016, ending inventory amounts would be determined by counting the vehicles on the lot at December 31, 2017 and determining from purchase invoices how much was paid for these.

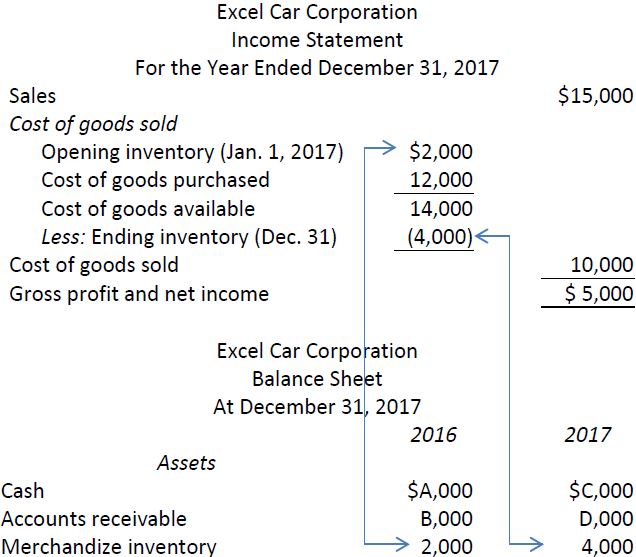

The interrelationship of inventory disclosed in the income statement and balance sheet using the periodic inventory system can be illustrated as follows:

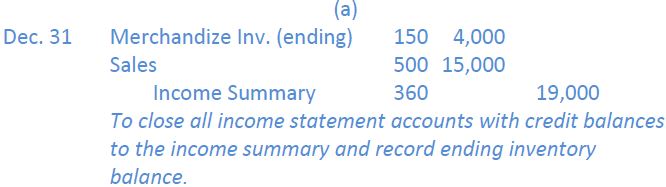

Closing entries for 2017 would be prepared using the same process as previously described.

Entry 1

Entry 2

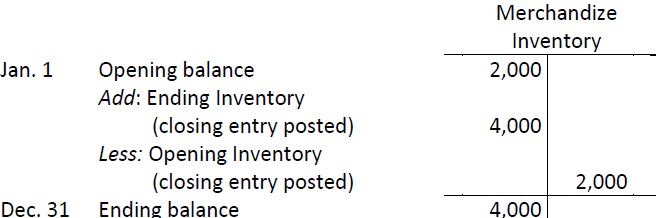

The combined effect of entries 1 and 2 on the Merchandize Inventory account is to adjust it to the actual ending balance at December 31, 2017 of $4,000. At the end of this process, the Merchandize Inventory account in the general ledger will show:

The usual entry is made to close the Income Summary account to the Retained Earnings account.

Entry 3

- 9759 reads