After obtaining a long-term loan, a company often purchases long-lived assets from a third party with the cash proceeds. The mechanics of recording a finance lease are much the same as that of a loan. The value of the finance lease is determined by calculating the amount of a similar loan that could be paid off, given the period of time, interest rate, and amount of payments stated in the lease agreement, and the fair value of the leased asset.

For instance, assume that on January 1, 2015 Big Dog Carworks Corp. agrees to pay First Leasing Company annual payments of $40,211 on December 31 for the next three years for the use of a large truck that could be purchased elsewhere for $100,000. BDCC is responsible for insuring, maintaining, and repairing the truck, thought title to the truck remains with the leasing company.

Even though BDCC does not legally own the truck, the substance of the lease agreement is the same is if the company received a 10% loan from a bank and then purchased the truck from a third party (recall the example above). As a result, BDCC is required under GAAP to record the finance lease as a liability and the truck as a long-lived asset on its balance sheet. When the lease agreement is signed on January 1, 2015 the following journal entry is made:

As in the first example, the truck asset is depreciated over its estimated useful life.

To record the loan payments, the implicit rate of interest within the lease agreement needs to be established. In the BDCC example, this is 10% – the amount of annual interest that would need to be paid to a bank for a similar loan.

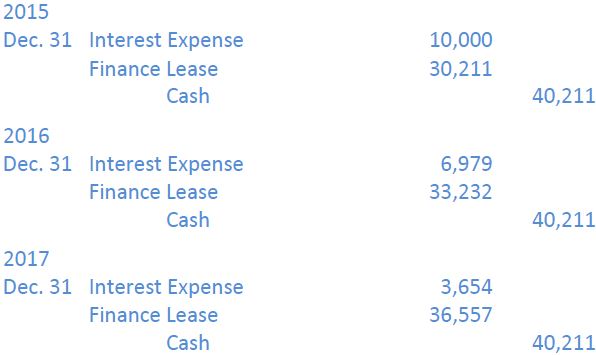

When each of the three payments is made on December 31 of 2015, 2016, and 2017, much the same journal entries are recorded as in the previous bank loan example:

Balance sheet presentation of the finance lease liability would also be similar. The same current and non-current portions would be presented each year as in the bank loan example above.

- 1914 reads