To set up the petty cash fund, a cheque is prepared for the amount of the fund. The custodian of the fund cashes the cheque and places the coins and currency in a locked box. Responsibility for the petty cash fund should be delegated to only one person, who should be held accountable for its contents. Cash payments, supported by receipts, are made by this petty cash custodian out of the fund as required. When the amount of cash has been reduced to a pre-determined level, the receipts are compiled and submitted for entry into the accounting system. A cheque is then issued to reimburse the petty cash fund for the total amount of the receipts. At any given time, the petty cash amount should consist of cash and supporting receipts, all totalling the petty cash fund amount. To demonstrate the management of a petty cash fund, assume that a $200 cheque is issued for the purpose of establishing a petty cash fund.

The journal entry is:

Petty Cash is a current asset account. When reporting Cash on the financial statements, the balances in Petty Cash and Cash are usually added together and reported as one amount.

Assume the petty cash custodian has receipts totalling $190 and $10 in coin and currency remaining in the petty cash box. The receipts consist of the following: delivery charges, $100; postage, $35; and office supplies, $55. The petty cash custodian submits the receipts to the accountant who records the following entry and issues a cheque for $190.

As an added internal control, petty cash receipts should be cancelled at the time of reimbursement in order to prevent their reuse for duplicate reimbursements. The petty cash custodian cashes the $190 cheque. The $190 plus the $10 of coin and currency in the locked box immediately prior to reimbursement equals the $200 total maintained in the petty cash fund.

Sometimes, the receipts plus the coin and currency in the petty cash locked box do not equal the required petty cash balance. To demonstrate, assume the same information above except that the coin and currency remaining in the petty cash locked box was $8. This amount plus the receipts for $190 equals $198 and not $200, indicating a shortage in the petty cash box. The entry at the time of reimbursement reflects the shortage and is recorded as:

Notice that the $192 credit to Cash plus the $8 of coin and currency remaining in the petty cash box immediately prior to reimbursement equals the $200 required total in the petty cash fund.

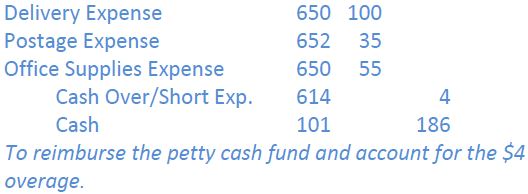

Assume, instead, that the coin and currency in the petty cash locked box was $14. This amount plus the receipts for $190 equals $204 and not $200, indicating an overage in the petty cash box. The entry at the time of reimbursement reflects the overage and is recorded as:

Again, notice that the $186 credit to Cash plus the $14 of coin and currency remaining in the petty cash box immediately prior to reimbursement equals the $200 required total in the petty cash fund.

The size of the petty cash fund should not be large enough to become a potential theft issue. If a petty cash fund is too large, it may be an indicator that transactions that should be paid by cheque are not being processed in accordance with company policy.

- 7642 reads