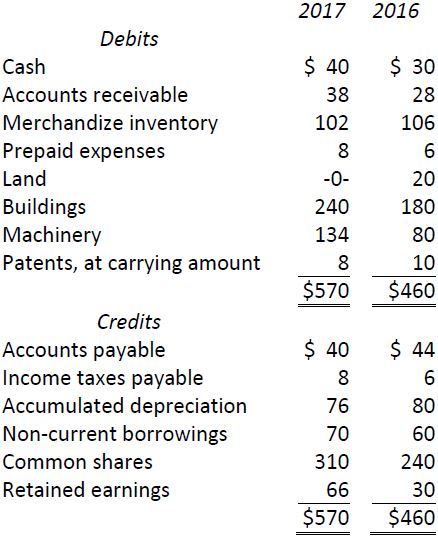

The balance sheet information of Cormier Limited at December 31 appears below.

The following additional information is available:

|

a. |

Net income for the year was $56,000; income taxes expense was $20,000. |

|

b. |

Depreciation recorded on building and machinery was $14,000. |

|

c. |

Amortization of patents amounted to $2,000. |

|

d. |

Machinery costing $30,000 was purchased; one-third was paid in cash and a 5-year loan assumed for the balance. |

|

e. |

Machinery costing $60,000 was purchased, and was paid for by issuing 6,000 common shares. |

|

f. |

Machinery was sold for $16,000 that originally cost $36,000 (one-half depreciated); loss or gain reported in the income statement. |

|

g. |

Addition to building was made for $60,000; paid cash. |

|

h. |

Land costing $20,000 was sold for $24,000 cash during the year. The related gain was reported in the income statement. |

|

i. |

Cash dividends of $20,000 were paid. |

|

j. |

No shares were reacquired. |

Required:

- Prepare a cash flow table.

- Prepare a statement of cash flows at December 31, 2017.

- What observations about Cormier can you make from this statement?

- 1757 reads