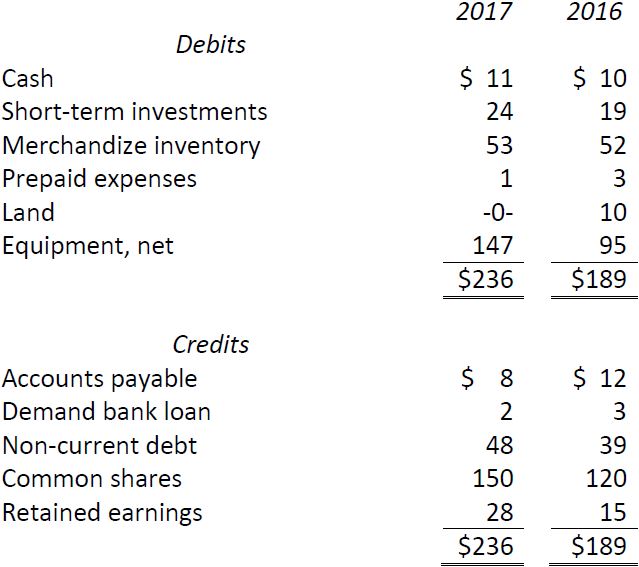

The records of Cambria Corporation showed the following information in the balance sheet accounts at December 31, 2017 and 2016.

Additional information for 2017:

|

a. |

Net income was $24; there were no income taxes. |

|

b. |

Cash dividends of $11 were paid. |

|

c. |

Depreciation expense was $3. |

|

d. |

Common shares were given in exchange for equipment costing $30. |

|

e. |

A building was purchased for $25; $16 was paid in cash and a noncurrent loan was assumed for the difference. |

|

f. |

Land purchased for $10 was sold for a $6 gain. The gain is included in net income. |

|

g. |

Short-term investments will be sold in 30 days for a known amount. |

Required:

- Explain the appropriate treatment for items d. and e. above.

- Prepare a cash flow table.

- Prepare a statement of cash flows.

- Explain what the statement of cash flows tells you about the Cambria Corporation.

- 1866 reads