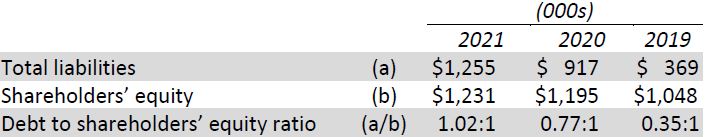

The proportion of creditor to shareholders’ claims is called the debt to shareholders’ equity ratio, and is calculated by dividing total liabilities by shareholders’ equity. In BDCC’s case, these amounts are:

In other words, BDCC has $1.02 of liabilities for each dollar of shareholders’ equity at the end of its current fiscal year, 2021. The proportion of debt financing has been increasing since 2019. In 2019 there was only $0.35 of debt for each $1 of shareholders’ equity. In 2021, creditors are financing a greater proportion of BDCC than are shareholders. This may be a cause for concern.

On the one hand, management’s reliance on creditor financing is good. Issuing additional shares might require existing shareholders to give up some of their control of BDCC. Creditor financing may also be more financially attractive to existing shareholders if it enables BDCC to earn more with the borrowed funds than the interest paid on the debt.

On the other hand, management’s increasing reliance on creditor financing increases risk because interest and principal have to be paid on this debt. Before deciding to extend credit, creditors often look at the total debt load of a company, and therefore the company’s ability to meet interest and principal payments in the future. Total earnings of BDCC could be reduced if high interest payments have to be made, especially if interest rates rise. Creditors are interested in a secure investment and may evaluate shareholder commitment by measuring relative amounts of capital invested. From the creditors’ perspective, the more capital invested by owners of the company, the greater the relative risk assumed by shareholders thus decreasing risk to creditors.

Although there is no single most appropriate debt to shareholders’ equity ratio, there are techniques for estimating the optimum balance. These are beyond the scope of introductory financial accounting. For now, it is sufficient to note that for BDCC the debt to shareholders’ equity ratio has increased considerably over the three-year period which is generally unfavourable because of the risk associated with debt financing.

- 1937 reads